How to buy Credit Agricole stocks in 2024

Credit Agricole Group is a French multinational banking group offering retail, corporate, insurance, and investment banking services in different parts of the world. It is the second-largest bank in France and the third-largest in Europe. The bank consists of a network of Crédit Agricole local banks, 39 Crédit Agricole regional banks, and Credit Agricole S.A., the holding company.

Credit Agricole S.A is listed on Euronext Paris, and it is a component of the CAC 40 stock market index. The bank is also a member of the Euro Stoxx 50 and Euronext 100 indices. This guide explains how you can buy Credit Agricole stock with confidence and why you might want to, taking various fundamental factors into account.

How to Buy CRARF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Credit Agricole

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need to Know About Credit Agricole

Now, we take a more detailed look at Credit Agricole, exploring its history and business strategy, how it makes money, and how the stock has performed in recent years.

Credit Agricole History

Credit Agricole’s history can be traced back to the Act of 1884 that established the freedom of professional association and authorised the creation of farm unions and the formation of local mutual banks. Being the first of its kind in France, the Credit Agricole company was created on 23 February 1885 at Salins-Les-Bains in the district of Poligny in the Jura region.

To promote lending to small family farms, the Act of 5 November 1894 was drafted to make way for the creation of Credit Agricole’s local banks. However, the first local banks were set up by local elites, such as agronomists, teachers, and property owners, instead of farmers. Only a few farmers were involved. After the turn of the 20th century, many more local and regional banks were established as the bank continued to build its nationwide coverage and expand its business activities.

The bank was later privatised, and it began to expand internationally, with the acquisition of stakes in multiple banks in Europe.

What Is Credit Agricole’s Strategy?

Credit Agricole is a universal bank that provides retail, corporate, insurance, and investment banking services in different parts of the globe. Its banking products and services include savings and current accounts and deposits, consumer finance products, payments and flow management services, specialised financial services, and wealth management services that allow individuals to manage, protect, and transfer their assets.

The bank also offers investment banking, commercial banking, structured finance, international trade finance, capital market. It further provides syndication services, as well as asset servicing solutions for investment products, including execution, clearing, forex, security lending, custody, fund administration, and middle-office solutions.

Credit Agricole’s strategy is based on running a powerful and well-coordinated international network and client-focused organisation with an automated and systematic measure of profitability. In addition, it offers market activities that complement the financing activities for its clients, and high value-added financing activities that generate a strong RONE (return on net equity). Finally, it manages to maintain a low-risk profile supported by an expert and conservative approach to its exposures.

How Does Credit Agricole Make Money?

As with other universal banks — offering both commercial and investment banking services, Credit Agricole makes money in different ways. Firstly, the bank has numerous fees for its services, such as account management or maintenance, depositing fees, overdraft fees, minimum balance fees, financial advice, and others.

The bank also cashes in the difference between the interest earned by lending money to customers and the interest paid on customer deposits. In other words, people deposit money at the bank, and the bank lends this money out to people looking for loans. The interest rate charged to people who borrow the funds is always higher than the interest paid by the bank to customers who deposited the money.

How Has Credit Agricole Performed in Recent Years?

As with most banking and financial stocks, Credit Agricole stock tends to show a cyclical pattern, swinging up and down, in line with the prevailing economic situation: it performs relatively well during periods of economic boom and declines when the economy is in bad shape.

Over the last five years, the stock has not performed very well. In fact, it has not reached the all-time high of €15.09 it made on August 6, 2017. It even fell as low as €6.00 in March 2020 when the coronavirus pandemic emerged. See the chart below:

Source: Yahoo! Finance

Where Can You Buy Credit Agricole Stock?

Trading a stock via CFD or spread betting is different from buying the stock from a stockbroker. While the latter allows you to own the stock, the former only allows you to speculate on the price movements of the stock.

You can own Credit Agricole shares if you buy them through a stockbroker that has access to the Euronext Paris stock exchange where the stock trades rather than through a CFD trading or spread betting platform. However, some CFD providers also allow you to buy real stocks.

Most stockbrokers offer only the standard dealing accounts, but UK-based stockbrokers also offer shares ISA and SIPP accounts, which are tax-efficient. Foreigners may also buy the Credit Agricole DR through their banks if they have a share-dealing arm.

Credit Agricole Fundamental Analysis

Unlike technical analysis that involves the use of a stock’s historical price action to forecast its future price movements, fundamental analysis is a way to determine the underlying health and intrinsic value of a company.

While there are many financial factors investors and analysts consider when performing fundamental analysis of a stock, in this guide, we will focus on the measurable financial metrics, such as the company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow.

Credit Agricole’s Revenue

A company’s revenue shows the amount of money it makes from the sale of its products or services when the costs of sales and other expenses have not been subtracted. You can find this metric at the top of the company’s income statement in its quarterly or yearly report or on your broker’s platform.

Revenue growth is a good thing for any stock as it shows that the company either has an expanding customer base or its customers spend more on its product and services. In the 2020 fiscal year, which ended on the 30th of December 2020, Credit Agricole reported revenue of €18 billion, which represents a 5.6% decline from the 2019 revenue — this can be attributed to the impact of the COVID-19 pandemic.

Source: Yahoo! Finance

Credit Agricole’s Earnings-per-Share

A company’s earnings are the profit left after all costs of doing business have been subtracted from the revenue. However, the total revenue is not of much importance to you since you own just a portion of the company represented by your shares. So, the earnings per share (EPS) is a highly relevant fundamental indicator for investors.

You can calculate a company’s EPS by dividing its total earnings by the total number of outstanding shares of its common stock. Still, you don’t need to do it yourself since you can get that from your stockbrokers’ website or any of the major financial websites. Credit Agricole’s annual EPS for the 2020 fiscal year was €0.80.

Credit Agricole’s P/E Ratio

The P/E ratio (price-to-earnings ratio) compares a company’s share price to its earnings-per-share. You can derive it by dividing the current share price by the annual EPS. Using Credit Agricole’s annual EPS of €0.80 for the 2020 fiscal year and the share price of €11.66 at the time of writing (September 18, 2021), the P/E ratio would be about 14.58 (11.66/0.80). This means that, at this time, investors are ready to pay $14.58 for every dollar the company earns in profits - this can be compared with industry peers to help you understand whether the bank performs well or not.

A high P/E ratio often indicates that the stock is overvalued. However, investors might overlook that and keep investing in the stock if they anticipate huge earnings in the future. Likewise, a low P/E ratio might indicate that the stock is undervalued.

Credit Agricole’s Dividend Yield

Credit Agricole is one of the companies that regularly pay dividends to their shareholders, and this may even be the most important way its investors gain from investing in this asset. While dividends can be paid quarterly, semi-annually, or annually, the company often pays annually. Whenever dividends are declared, the share price rises until the ex-dividend date and then falls.

The dividend yield is a metric that compares the total annual dividends to the share price. For example, given Credit Agricole’s annual dividend of €0.80 per share for the 2020 fiscal year and a share price of €11.66 (Sept. 18, 2021), the dividend yield is 6.86% (0.80/11.66). You don’t need to calculate this yourself because you can see it along with other financial ratios on your stockbroker’s website or any of the major financial websites.

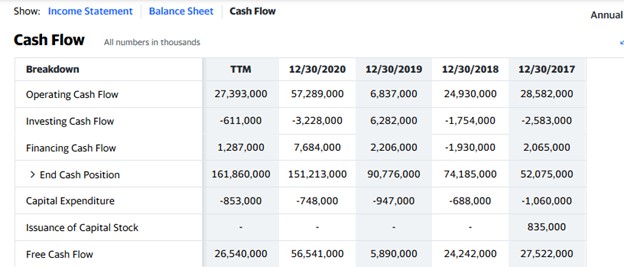

Credit Agricole’s Cash Flow

Cash flow refers to how cash and its equivalents flow in and out of a business. You can see the cash flow statement beside the other financial statements in the financial section of the company’s information on a broker’s website or any of the major financial websites, as in the picture below:

Source: Yahoo! Finance

The most important figure in that statement is the free cash flow; it shows how much cash the company has left after paying for major expenses. It is this cash that the company can use to fund expansion, pay dividends, or pay down debts. From the image above, you can see that Credit Agricole had over € 56 billion in free cash flow by the end of the 2020 fiscal year.

Why Buy Credit Agricole Stocks?

As with most banking stocks, Credit Agricole stock doesn’t show a sustained performance over a long time; instead, the stock waxes and wanes in line with the state of the economy. But even at that, the bank may be a solid stock for value investors and dividend hunters.

These are some of the reasons you might want to buy Credit Agricole stock:

- At €11.66 per share (Sept. 18, 2021), the stock is relatively cheap, with a P/E ratio of 14.58.

- The stock may be attractive to value investors.

- The company has a history of paying regular dividends.

Expert Tip on Buying Credit Agricole Stock

“ Credit Agricole is not the growth type of stock that investors gain mostly from capital appreciation. The stock is for dividend hunters, as most of your gains would be from dividend payments. To improve your dividend yield, you want to buy the stock when it is cheap. With its cyclical pattern, this means buying at the low point of the cycle. ”- willfenton

5 Things to Consider Before You Buy Credit Agricole Stock

You have to consider these five things before you buy Credit Agricole stock:

1. Understand the Company

It is necessary to study the company to understand its business model and financial state. As Peter Lynch suggested, it may be reasonable to invest in a company you are familiar with. However, this is not sufficient if you don’t also consider the fundamental factors. You may be banking with Credit Agricole and like their services, but that doesn’t automatically mean that the stock is great; you have to study the fundamental factors.

2. Understand the Basics of Investing

It is necessary to learn the basics of investing before putting money in the market. This way, you understand how the market works and what you can do to protect your investing capital. Some of the key things to learn include how to execute orders and how to manage risks, including money management, risk management, and diversification.

3. Carefully Choose Your Broker

There are many stockbrokers to choose from, so you have to have criteria for selecting the one that suits you. The most important factor to consider is whether the broker is regulated in your country of residence. This offers you some form of protection. For example, in the UK, your fund will be covered by the financial services compensation scheme (FSCS) in the case of a broker’s bankruptcy.

Other factors to consider before choosing a broker include trading fees, trading platform and tools, customer support services, payment methods, and supported order types.

4. Decide How Much You Want to Invest

Determine how much you want to invest and the percentage to allocate to each stock. When you have done that, plan how you want to put the money in the market: while you can invest the lump sum at once, it may be preferable to practice dollar-cost-averaging and scale in at intervals. It reduces the impact of volatility.

It is very important you invest only disposable income you can afford to lose without affecting your lifestyle. Don’t invest the money you use for daily needs or paying your bills. Also, never invest with borrowed funds no matter how great the stock appears — leverage can cost you your shirt unless you know how to use it.

5. Decide on a Goal for Your Investment

Define your goal for investing in the stock market. It could be to raise money for your kids’ college or build a pension fund for retirement. Whatever the reason for investing, you should plan when you would cash in on your investment: it may be when the price reaches a particular level, when the fundamentals no longer stack up, or when your kids reach a certain age. You may hold indefinitely and sell as the need arises.

The Bottom Line on Buying Credit Agricole Stocks

Credit Agricole is a French multinational bank that offers commercial and investment banking services. If you are a dividend hunter, the stock may be a suitable one, and you can buy it through a stockbroker with access to the Euronext Paris stock exchange.

Are you ready to invest right now? Create a trading account by registering with a stockbroker and look for Credit Agricole stock on its platform. Then, place a buy order, which can be a market or limit order.

If you’re not ready to invest right now, you can continue to read other guides on our website to get more information about investing. You can also “paper trade” with a stockbroker’s demo account to learn how to place orders.

Frequently Asked Questions

-

This is a financial service that helps to facilitate large and complex financial transactions, such as initial public offerings (IPOs) and mergers and acquisitions. It may also involve brokerage or financial advisory services to large institutional clients such as pension funds. Banks that offer such services are known as investment banks.

-

A universal bank is a bank that provides a wide variety of banking and other financial services, including retail banking, investment banking, insurance, and more. It is usually a holding company that has both a commercial bank and an investment bank.

A universal bank participates in many kinds of banking activities and is both a commercial bank and an investment bank and provides other financial services, such as insurance.

-

Generally, when you invest in a stock, you make money from capital gain and dividends if the company pays cash dividends. It is the same thing when you invest in Credit Agricole stock. However, the stock is known for its lacklustre performance, so you make money mostly from dividends.

-

Capital gain is how much a stock price has risen after you bought it. It is the difference between the price you bought the stock and the price you sold it. For instance, if you buy a stock for €10.00 per share and sell it at €15.50 per share, you have made a capital gain of €5.50.

-

Dividends are cash payments a company makes to its shareholders as a reward for investing in the company. They are usually paid from a portion of the company’s earnings for the reporting period when they are declared. Dividends can be paid quarterly, half-yearly, or yearly.

-

You can diversify your investment by allocating your capital across different, non-correlating stocks or assets. Another option is to commit only a small portion of your capital in one stock at a time and also use a stop-loss order to ensure you limit your losses to a specified amount.