How to buy Natura stocks in 2024

Natura is one of the leading manufacturers of beauty care cosmetic products based in Brazil. It's a part of the Natura & CO Group comprising four brands, including Natura, Aesop, AVON, and The Bodyshop. With more than 3,200 stores located in 73 countries, the company ensures its presence across all the continents except Antarctica. The company's main competitors in the home country include O Boticario and Jequito. Besides being a sustainable company, it takes pride in research and development efforts to preserve the natural environment and remain eco-friendly.

While Roberto Marques heads the board of directors, Joao Paulo Ferreira holds the company reins as a Chief Executive Officer (CEO). Despite being a little more expensive than most of its competitors, Natura stock can be a worthwhile addition to your investment portfolio. In this piece, we discuss how you can buy Natura Stock in detail.

How to Buy NTCO Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in Natura

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About Natura

Before learning more about the company, let's quickly review its history, strategy, and revenue streams.

Natura’s History

Founded in 1969 by Antonio Luiz Seabra, Natura started its operations as a retail business. However, after realising more potential in door-to-door sales, the company abandoned retail activities and recruited over 2000 salespersons that helped it reach $5 million in annual sales revenue by the end of 1974.

Direct sales allowed the company to have the edge over retailers in understanding consumer behaviour and plan accordingly. This business strategy allegedly made it easier for the company to promote and sell its products, whereas retailers could only focus on a few hot sellers.

Following the success in distribution sales, the company kept expanding its operations and stepped into the international market in 1982. A year later, the company introduced product refilling and became the country's first-ever cosmetic company to offer such services.

Over the next ten years, the company heavily invested in technology as well as quality control. After spending almost $1.5 million in research and development, followed by a two-year trial period, the firm announced the addition of a separate line of products comprising janitorial items and anti-ageing creams in 1986. The company managed to set a new record with its annual sales amounting to $180 million a year by the end of 1990. Over the next five years, the company had 270 products added to its range of offerings.

In 2001, Launching the Ekos line, the company incorporated Brazilian biodiversity ingredients into its product line. Natura opened its new headquarter in Cajamar and set up a factory at the cost of $110 Million in 2001. The company went public by selling 22% of its stock on the Sao Paulo Stock Exchange in 2004. After opening its first store in Paris the following year, Natura launched the Carbon Neutral Program in 2007.

The next decade witnessed the company acquiring 65% equity of Aesop and completing the purchase for $71.6 million by the end of 2016. The company opened its first store in Brazil and established its foot in New York in the same year.

Following the acquisition of the British cosmetics and skincare company "The BodyShop" in 2017, the Group became interested in buying Avon Products Inc., anticipating the $2 billion deal to be completed in early 2020. On January 03, 2020, Natura & Co concluded the purchase and became the world's 4th largest beauty group having a reported net worth of 13.5 billion U.S. dollars as of May 28, 2021.

What Is Natura's Strategy?

Natura offers innovative products and promotes well-being through relationships having a focus on sustainable development.

The company's business model includes direct sales with over 1.7 million consultants across the globe. Its business strategy aligns with the triple bottom line framework. With the Life Cycle Assessment approach that comprises raw material extraction, logistics, processing, manufacturing, and packaging, the company seeks to create values for clients and the environment.

In addition, Natura uses organic resources and manufactures products with sustainable ingredients like Brazilian nut, palm oil, and pitanga obtained from the Amazonian flora.

How Does Natura Make Money?

Natura develops, manufactures, and distributes beauty and personal care products, including skincare, solar filters, perfumes, cosmetics, and hair care products, through its direct sales channels and representatives in many countries worldwide to generate its source of income.

How Has Natura Performed in Recent Years?

After a low of $8.7 in March-April 2020, the NTCO stock has been steadily rising. Natura & Co stock has risen almost 89% in a year. Despite the impact of Covid-19, growth across its all brands and digital social selling helped the company's stock follow an uptrend. Not to mention, the $1 billion capital raised in October 2020 enabled the Group to reduce its net debt to EBITDA ratio to 0.97, pushing the stock price up to $23.4 by June 2021. However, the stock price has fallen to the same position it was almost half a year ago. As of this writing, NTCO stock hovers around $16.22.

Where Can You Buy Natura's Stock?

Natura lists its shares on the Sao Paulo stock exchange. You can buy the company stock using a stockbroker. All you need is to open a live trading account with the broker. Owing to regulatory requirements, all brokerage firms ask you to complete the KYC process for account verification. Once your account is verified, you can start buying the NTCO stock by adding funds to it. Alternatively, you can also seek the assistance of a financial advisor to help you buy the company stock. Checking the availability of a stock purchase facility with your bank is another viable option to consider.

Natura Fundamental Analysis

Fundamental analysis is one of the most crucial tools that enable investors to assess a stock's intrinsic value. It helps them determine whether the stock price reflects the company's worth in real terms? Besides examining the industry's economic outlook, investors tend to assess the company's management effectiveness and efficiency to ascertain whether a stock is worth investing in.

Investors typically research variables like price-earnings ratio (P/E), dividend yield, cash flows, EPS, revenue, etc. Let's learn what these terms mean and how they become helpful for stakeholders in the decision-making process.

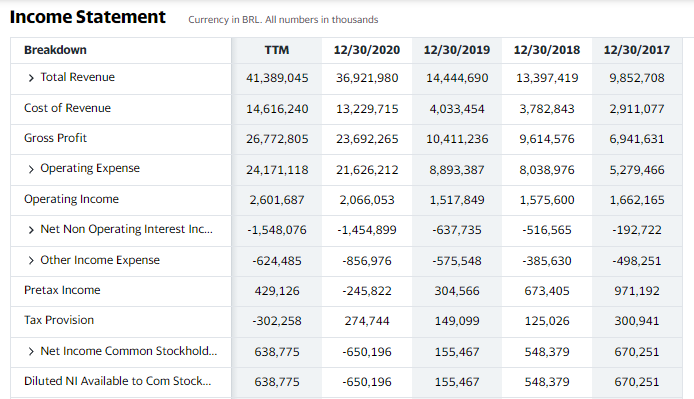

Natura's Revenue

Revenue is money that a business generates from the sales of its products and services. You calculate it by multiplying the average sales price by the number of units sold over an accounting period. It is the top line appearing on a company's income statement from which you can figure out a company's net income after the deduction of relevant expenses (direct and indirect). Given below is the table showing Natura's revenue for recent years. It seems to have been consistently increasing over the years.

Source: Yahoo! Finance

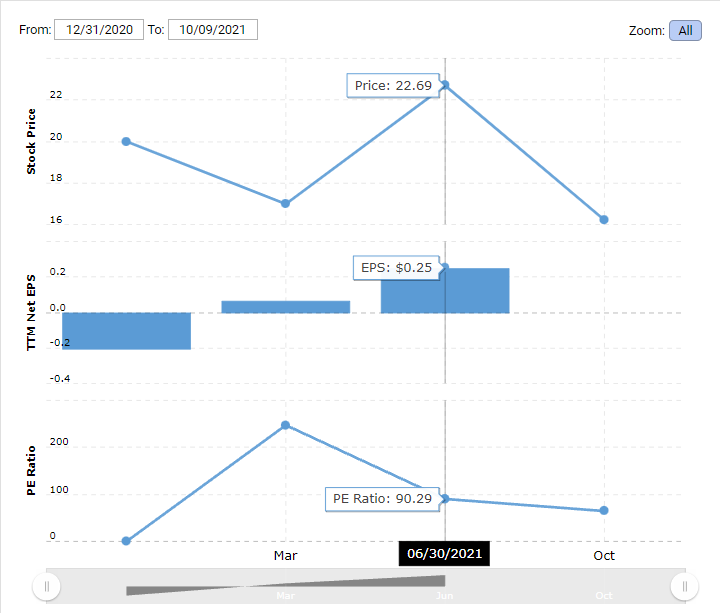

Natura's Earning-Per-Share (EPS)

EPS helps investors to find out a company's profitability ratio. You can calculate a company's EPS by dividing its net earnings available to ordinary shareholders by the total numbers of outstanding shares.

While higher EPS indicates better profitability, investors willingly pay much higher prices for stocks with high EPS values. Natura & Co Holding EPS for the year ended June 30, 2021, was $0.25, with a year-over-year decline of nearly 158%.

Natura's P/E ratio

This ratio compares a stock's market value to its earnings. It tells you whether the price accurately reflects the company's earning potential. The P/E ratio is an easy way to determine whether a stock is overvalued or undervalued.

To find a company's P/E ratio, you can divide the latest closing stock price by the company's most recent EPS. Because of being simple to calculate, the PE ratio is the most widely used valuation measure. While the company's stock had been trading around 22.69 with an EPS standing around $0.25, Natura's P/E ratio was 90.29 as of June 30, 2021.

Source: Macrotrends

Natura's Dividend Yield

A company's dividend yield is the percentage of its current share price that it pays out as annual dividends. Putting it simply, if a corporation pays out annual dividends of 1 cent per share and its share price is $1, then the dividend yield would be 1%.

Companies have different policies for paying dividends, such as annual, semi-annual, etc. Notably, profitable companies do not entice investors unless they pay dividends to them. Since companies are not bound to pay dividends, they can pay or revoke dividend payments depending upon the business financial outlook.

Not to mention, companies with high dividend yields don't automatically make a good investment opportunity. Sometimes organisations pay high dividends to retain shareholders interest. As far as Natura's dividend yield is concerned, it hasn’t paid any dividend over the past 12 months, leaving us unable to calculate its dividend yield.

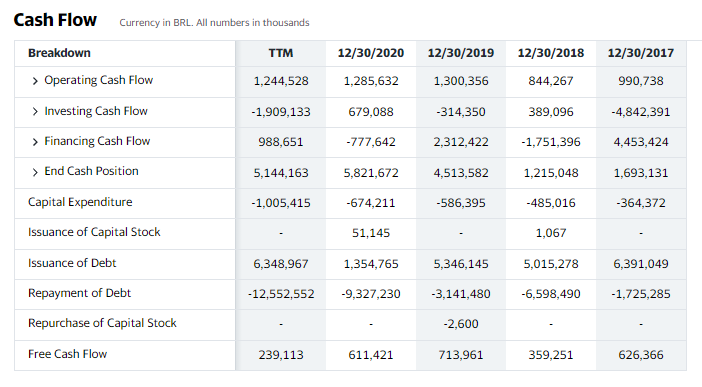

Natura's Cash Flow

A cash flow statement summarises a company's cash and cash equivalents coming in and going out of a business in a specific period. While the cash flow statement reflects a company's ability to pay back debt and cover operating expenses, It is crucial to analyse it carefully before making a final decision.

Investors usually look for a company's free cash flows since firms use them to expand their operations or disburse dividends. You can find out a company's cash flow statement under the financials head on its official website. Your stockbroker may also have the company's financials available for your convenience.

By looking at Natura's cash flows below, we can determine why the company couldn't pay out dividends. Its free cash flows seem to have been reduced drastically over the last couple of years.

Source: Yahoo! Finance

Why Buy Natura's Stock?

Despite booking a loss of R$820.8 million in the first quarter amid the pandemic, the group managed to narrow down the negative economic outlook by limiting the operating loss to R$156.6 million in the same period in the following year. The company also started witnessing a substantial increase in sales revenue across all its brands as soon as it reopened after the COVID 19 led shutdowns.

It essentially unveils the management's ability to handle unforeseen tragic events and keep the company on the right track. Also, the company's share price has risen by more than 40% over the last couple of years, suggesting that the stock holds the right potential to grow even further. However, before vesting your stake in the company's stock, do plenty of research and only invest in the company if you feel confident about it.

Expert Tip On Buying Natura’s Stock

“ China has recently exempted most imported beauty products from mandatory animal testing. This regulatory change could benefit Natura & Co because it has refrained from operating in China amid its cruelty-free stance. However, the company is now preparing its brand like Aesop, for a wild ride in 2021. Hence, the company might find a lot of potential to make substantial profits while operating in one of the world's biggest consumer markets. Therefore, it can be a viable investment opportunity for those willing to take risky investment initiatives. ”

5 Things to Consider Before You Buy Natura Stock

Below are the five factors that you should consider before holding your interest in the company's stock.

1. Understand the company

While buying a company's stock, you must do sufficient research. Verify your knowledge about the company through different resources, such as the company's financials and reading through expert analysis. Ideally, it is best to invest in a company you already use. However, a company's investment potential should not back personal preferences. Always carefully learn the company's business model, and look for other variables, including revenue sources, turn-over ratio, and growth potential. Also, consider the company's past performance before stepping ahead.

2. Understand the Basics of Investing

You must learn the basics of investing before entering the stock market. Having clear goals and a strategy is critical to achieving your desired profit targets. You can limit your risk by applying a portfolio diversification strategy. Initially, you can start low and gradually increase your investment after becoming familiar with the stock market.

3. Carefully Choose Your Broker

Choosing a broker can be difficult, especially if you are new to trading. But a little guidance can help. Preferably you should sign up with a regulated broker instead of a non-regulated one. Regulated brokers tend to be safer and more transparent. Examine the fees for buying and selling shares with your prospective broker. Aside from multiple trading platforms (web, PC, and mobile), your prospective broker should have a large stock selection and a wide range of beginner level and advanced trading tools available. Check if your selected broker offers free charts and indicators besides supporting different order types (stop, limit, trailing stops, etc.). Finally, it should be providing customer facilitation service round the clock.

4. Decide How Much You Want to Invest

Deciding the maximum amount you can spare for investment in the stock market is critically essential. Because that's how you can not only determine your risk tolerance level but ascertain how long could the company take to pay back your investment. It will also make it easy for you to separate the amount you might be needing to meet your routine expenses.

5. Decide on a Goal for Your Investment

You must be very clear concerning your investment goals. For example, if you wish to save for your retirement, you need to buy company stock and hold it long-term. No doubt, holding will help you receive dividend payments and increase the value of your shares over time. However, if you only intend to make short-term profits, intraday stock trading might appeal to you more.

The Bottom Line on Buying Natura Stocks

With increased sales through its digital channels across all brands, Natura &Co outperformed the global Cosmetics, Child Toiletries and Fragrance market in Q4 2020. The Group consolidated net revenue amounted to R$12 billion as of December 30, 2021.

However, the company's cash flow statement doesn't look too good to offer reasonable assurance concerning the company's liquidity. Also, the company has put dividend payments on halt for an unspecified period, which could make clients a little concerned. Ever since the company announced its plan to enter the Chinese market, analysts seem optimistic and anticipate it to be making excessive profits and exponential growth.

If you feel ready to buy Natura stock, the process is pretty simple. Open a live funded account with your prefered stock broker and place a trade.

However, if you're still not prepared to stake your interest in the company, there is no rush either. Keep doing plenty of research and read through expert analysis on the company's stock, and only invest in the company when you feel comfortable. You can also find a lot of guides about investing on our websites.

Frequently Asked Questions

-

Natura lists its shares on the Brazilian stock exchange - Sao Paulo under the ticker NTCO.

-

Investing in stock has no set amount. Many variables affect the minimum and maximum investment amounts. It also depends on your preferred deposit method, investment strategy, and the stockbroker you choose to buy the company's stock.

-

You can start buying Natura stock straight after opening an account with a stockbroker. However, you also need to complete the KYC process to verify your account, which could take a day or two.

-

Dividends allow companies to distribute profits to shareholders, thanking them for their continued support and encouraging them to hold the stocks. However, the amount a company chooses to pay as dividends depends upon the company's profitability and availability of free cash flows. Natura hasn't been paying any dividends since 2020.

-

You can employ a stop-loss feature while placing a trade. It will automatically close your position if the market moves beyond your risk tolerance level as specified.

-

Traders benefit from both fundamental and technical analysis. Technical analysis is used for short-term investment decisions, while fundamental analysis offers long-term insights into a business.