How to buy Nintendo stocks in 2025

Nintendo Co., Ltd. is a Japanese multinational company that develops, manufactures, and supplies electronic entertainment products in Japan and the rest of the world. With multiple subsidiaries in Japan and abroad, Nintendo is one of the wealthiest and most valuable Japanese companies. Nintendo has received many awards, including Emmy Awards for Technology & Engineering and Game Developers Choice Awards.

The company went public on the Second Section of the Osaka Securities Exchange and the Kyoto Stock Exchange in 1962. This guide tells why you might want to buy Nintendo stock after taking various fundamental factors into account and also shows you how and where to buy it.

How to Buy NTDOF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in Nintendo

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About Nintendo

At this point, we take a more detailed look at Nintendo Co., Ltd. by exploring its history and business strategy, the ways it makes money, and how the stock has performed in recent years.

Nintendo History

The company was founded on the 23rd of September 1889 as Nintendo Karuta by craftsman Fusajiro Yamauchi. The company was originally founded to produce handmade hanafuda playing cards. It tried its hands in various lines of business, especially during the 1960s. In 1962, the company went public, listing its shares on the Second Section of the Osaka Securities Exchange and the Kyoto Stock Exchange.

However, it was in the 1970s that Nintendo delved into the world of electronics and video games; it distributed its first video game console, the Color TV-Game, in 1977. The company gained international recognition with the release of Donkey Kong in 1981 and the Nintendo Entertainment System and Super Mario Bros.

In 1985, and since then, it has produced some of the most successful consoles in the video game industry, including the Game Boy, the Super Nintendo Entertainment System, the Nintendo DS, the Wii, and the Nintendo Switch. The company has developed various franchises, including the popular Pokémon, Kirby, and Metroid.

What Is Nintendo’s Strategy?

Nintendo is known in Japan and internationally for creating video game platforms, as well as handheld and home console hardware systems and related software. Although Nintendo faces serious competition from Sony's PlayStation or Microsoft's Xbox, it has managed to use the blue ocean strategy to differentiate its product from the competition.

The company’s strategy to differentiate itself from its competition has positioned it to succeed without having to compete directly with the latest consoles from Microsoft and Sony. The company focused less on hardware specs and instead introduced a novel gameplay experience that catered more to family gaming, thereby creating a new market for itself.

By offering the Wii console, the company avoided direct competition from the industry and targeted the non-gamers segment. And with the Wii selling over 102 million units, ahead of Microsoft’s Xbox 360 (86 million units) and Sony’s PlayStation 3 (88 million units), the strategy has been a successful one.

How Does Nintendo Make Money?

Nintendo makes money from the sale of its electronic entertainment products and services, which includes video games, handheld and home console hardware systems, and related software, in different parts of the world.

As with other console-based home entertainment companies, Nintendo’s revenue comes from continually making and licensing games. The company continually makes new additions to its beloved franchises and gives other companies the avenue to make and add their own games while remunerating Nintendo for the privilege.

Apart from this traditional way of making money, the company tries to improve income using its “Unfold System”, which takes away the need to release new games in a franchise. With this new system, instead of releasing new games and issuing licenses, one game can be unfolded with new lands and adventures that make it bigger and make the player feel as though the game is naturally evolving.

How Has Nintendo Performed in Recent Years?

After Nintendo’s share price ramp-up in the mid-2000s, making more than 700% profits over a period of 4 years and reaching its all-time high of ¥72,100.00 in October 2007, the stock gradually declined in the following eight years, falling as low as less than ¥10,000.00. From 2015, the stock started rising again, reaching ¥69,830.00 (quite close to the all-time high) in Dec. 2020.

However, since the beginning of 2021, the stock has been in a pullback. As of the time of writing (Oct. 5, 2021), the stock is trading around ¥49,600.00, which is 29.0% below the December 2020 high.

Source: Yahoo! Finance

Where Can You Buy Nintendo Stock?

Nintendo stock trades on Japanese stock exchanges, so you need an international stockbroker with access to those exchanges to buy the stock if you want to own shares of the company. However, if you only want to speculate on the price movements of the stock without owning the shares, you can trade the stock via a spread betting or CFD trading platform, although some major CFD platforms can also allow you to buy real stocks.

When trading through an international stockbroker, you can open a standard share dealing account or the tax-friendly shares ISA and SIPP accounts if it’s a UK-based stockbroker. In your country of residence, some major commercial banks with a share dealing arm may also offer Nintendo DR. In the US, Nintendo ADR trades over the counter (OTC) with the ticker symbol NTDOF.

Nintendo Fundamental Analysis

Fundamental analysis is a way of evaluating a stock by studying the company’s business to know its intrinsic value and growth potential. It is not like technical analysis where traders use historical price action and certain price patterns to forecast future price movements.

When performing fundamental analysis of a stock, there are key financial metrics you have to study. While some of them, such as the P/E ratio, revenue, earnings-per-share, dividend yield, and cash flow, are measurable, some are not — company’s management and goodwill. In this guide, we’ll focus on measurable ones.

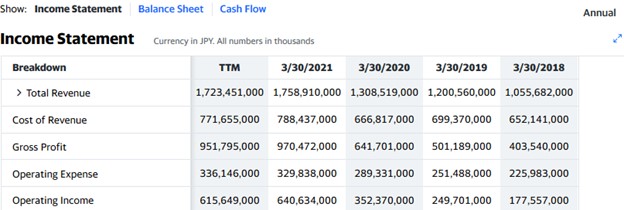

Nintendo’s Revenue

Revenue is the amount of money a company makes from the sales of its products or services before any costs have been deducted to get the profits (earnings). A company’s revenue is always presented at the top of its income statement for the accounting period under review, which is why it is called the top line.

The higher the revenue, especially when compared to a similar period in the preceding year, the better. Nintendo’s revenue rose 34.4%, from ¥1.31 trillion to ¥1.76 trillion, for the 2020/2021 fiscal year, which ended March 30, 2021.

Source: Yahoo! Finance

Nintendo’s Earnings-per-Share

A company’s earnings are the profit recorded for the accounting period after all costs of doing business have been deducted from its revenues. It is usually referred to as the “bottom line”. But since you only own some shares in the company (and not the entire company), you should be more interested in earnings per share (EPS) rather than the total earnings. The EPS is the amount the company earned for each outstanding share of its common stock.

For example, Nintendo’s EPS is calculated by dividing its net earnings (less the dividends paid to preferred stockholders) by the number of common shares outstanding. However, you don’t need to do the calculation yourself since it is available on stockbrokers’ websites or any major financial website. Nintendo’s EPS for the 2020/2021 fiscal year is ¥4,003.

Nintendo’s P/E Ratio

The price-earnings (P/E) ratio is a metric that compares a company’s share price to its earnings-per-share. It is calculated by dividing the current share price by the EPS.

For example, with Nintendo’s share price at ¥49,600.00 and its EPS being ¥4,003, the P/E ratio would be about 12.39. Thus, as of October 2021, investors are ready to pay ¥12.39 for every yen the company earns in profits.

Generally, companies with very high P/E ratios are considered overvalued, but it could also be that investors are anticipating huge earnings in the future.

Nintendo’s Dividend Yield

Some companies distribute a portion of their earnings to their shareholders as cash dividends, and they may do this quarterly, semi-annually, or annually. When dividends are declared, the share price rises until after the ex-dividend date and then declines.

A dividend yield compares a company’s total annual dividends to its share price. For example, if a company pays out annual dividends of ¥2,200 per share when its share price is ¥50,000, its dividend yield would be 4.4%. While you can do the calculation yourself, the dividend yield is often seen alongside other financial ratios on the stockbroker’s website or any of the major financial websites.

Nintendo pays semi-annual dividends. For the 2020/2021 fiscal year, it paid an interim dividend of 810 yen in September 2020 and a final dividend of 1,410 in March 2021, bringing the total annual dividend to 2,220 yen.

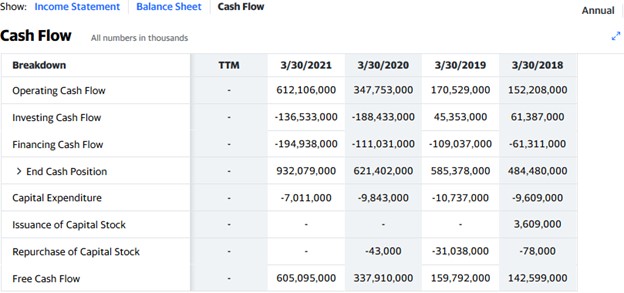

Nintendo’s Cash Flow

Cash flow refers to how money flows in and out of a business. It is recorded in the cash flow statement, which is one of the three financial statements you need to study when analysing a company. You will see the cash flow statement beside the other financial statements in the financial section of the company’s information on a broker’s website or any of the major financial websites.

See Nintendo’s cash flow statement for the 2020/2021 fiscal year below:

Source: Yahoo! Finance

The most important information in that statement is the free cash flow, which is over 605 billion yen. This represents the amount of cash or cash equivalents left after the company has paid for major expenses necessary for running the business, including building, equipment, and other bills. That is what the company has to fund expansion, pay dividends, or pay down debts.

Why Buy Nintendo Stocks?

Nintendo’s fundamentals are quite solid, and the stock has been performing very well in the past six years. Even though the company has been facing stiff competition from Sonny and others, its astute management team has been able to use innovative ideas to create new markets for its products and also improve its revenue generation methods.

Here are three reasons you might want to buy Nintendo stock:

- The company is well managed;

- It is continually creating ways to generate more revenue;

- Nintendo pays regular dividends, which can be another source of income.

Expert Tip on Buying Nintendo Stock

“ As of October 5, 2021, the stock is still in a dip that started at the beginning of 2021, after a ramp-up in 2020. There’s no way to know when or where the dip would end, so it is not advisable to place a buy limit order. Instead, wait for the price to reverse first and then enter with a market order. ”- willfenton

5 Things to Consider Before You Buy Nintendo Stock

These are five important things you must consider before you buy any stock:

1. Understand the Company

Of course, there is no harm in investing in a company you are familiar with or like its products/services. But that would never be sufficient without also considering the fundamental factors. You may love Nintendo video games, but is the company making money? You need to study their business model, management team, and financial ratios to know whether it is a good business.

2. Understand the Basics of Investing

Have you taken your time to learn about investing in the past? If the answer is no, you have to learn the basics first before putting your money in the market. Read some of our resources on investing basics and also check some financial dictionaries to learn some investing terminologies. This way, you can understand financial statements and analysis. Above all, learn how to properly place orders and how to manage risks, including risk management, money management, and diversification strategies.

3. Carefully Choose Your Broker

Choose a broker that is regulated in your country of residence. This can offer you some form of protection — for example, your fund will be insured against brokerage bankruptcy if there is a compensation scheme, such as the Financial Services Compensation Scheme (FSCS) in the UK.

Other factors to consider before choosing a broker include the broker’s asset offerings, supported order types (market order or limit order), trading commissions, trading platforms (desktop, web, or mobile), payment methods, and customer support service.

4. Decide How Much You Want to Invest

Determine how much to budget for investment and the percentage you want to commit to one stock. You should also plan how to buy whichever stock you intend to buy: while you can buy all the shares you plan to buy in one trade, it may be wise to practice dollar-cost averaging.

One more thing, do not invest more than you can afford to lose and avoid using borrowed funds, including the leverage offered by your broker. While leverage can increase potential profits, it can also amplify losses. If you’re a beginner, avoid leverage until you gain experience.

5. Decide on a Goal for Your Investment

Lastly, you must have an investment goal. What do you hope to achieve with the investment? It could be that you want to build your pension fund for retirement, plan for a future project, or raise money for your kid’s college. Whatever the reason, it’s important you know how long to hold the investment and when to cash out. Is it when the price gets to a particular level, when the fundamentals are weak, or when you need the money, or do you want to hold indefinitely?

The Bottom Line on Buying Nintendo Stocks

Nintendo is a Japanese multinational company that creates and sells video games in Japan and the rest of the world. You might want to invest in this stock if you want to earn regular income from dividends, and you can buy it through an international broker with access to Japanese stock exchanges or via the OTC marketplace in the US.

Ready to invest in Nintendo stock right now? Sign up for a stockbroker’s share dealing account or register on the OTC marketplace and look for the stock in the list of stocks. Click the “buy” button to buy at a quoted price or place a limit order to buy at the maximum price you’re willing to pay.

If you’re not ready to invest right now, continue to read other guides on our website to learn more about investing. You may “paper trade” using a stockbroker’s demo account to learn how to place orders in the market.

Frequently Asked Questions

-

A company’s net earnings are called its bottom line because it is placed at the bottom line of the income statement. In other words, the net earnings are the last figure you will see on any company’s income statement. It shows how much the company has earned after all the expenses have been deducted, and it can be positive (profits) or negative (losses).

-

It is a technical term coined by INSEAD business school professors Chan Kim and Renee Mauborgne in their book, Blue Ocean Strategy. The term is used to explain a marketing strategy that focuses on creating a new market instead of competing in an already existing market.

With a blue ocean strategy, a company creates products that will entice a new demographic group. For example, Wii Nintendo targets the entire family, instead of competing with PlayStation for the usual game-loving youth.

-

An OTC (over-the-counter) marketplace is a market where financial securities are traded through a broker-dealer network as opposed to a centralized exchange. Examples include Pink OTC Markets Inc. (owned by OTC Markets Group Inc.) and the OTC Bulletin Board (OTCBB) In the US. The Alternative Investment Market (AIM) in the UK also qualifies as an OTC marketplace.

-

Dollar-cost averaging (DCA) is an investment technique whereby an investor makes regular incremental investments over a period as opposed to making a lump-sum purchase in one trade. The investor divides up the total amount and invests a fixed amount at regular intervals. In the end, the average purchase price becomes the entry price. This strategy helps to reduce the effects of volatility.

-

It depends; if you intend to buy and hold indefinitely, fundamental analysis alone may be enough. However, if your intention is short-term trading, you need to know the right time to buy and sell the stock, so technical analysis becomes very useful.

-

Yes, your profits would be taxed, depending on how long you held the stock before selling. If you held the stock for one year or less, your profits will be taxed as short-term capital gains, but if you held for longer than one year, the profits will be taxed at the long-term capital gains rate.