How to buy PharmaMar stocks in 2024

PharmaMar is a Spanish biopharmaceutical company that engages in the research and development, production, and marketing of drugs derived from marine-related resources for the treatment of cancer and Alzheimer's in Europe and the rest of the world.

The company, through its subsidiary Genomica, develops molecular testing procedures for several infectious diseases (including COVID-19) and offers genetic analysis and paternity testing. Through another subsidiary, Sylentis, PharmaMar also develops gene therapies based on gene silencing techniques like RNA interference.

Headquartered in Colmenar Viejo, Madrid, Spain, its stock is listed on the Madrid Stock Exchange and, since 2020, has been a component of the IBEX 35 Index. With this guide, you will learn how you can buy PharmaMar stock with confidence, and why you might want to, taking various fundamental factors into account.

How to Buy PHMMF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Best Reviewed Brokers to Buy PharmaMar Stocks

1. eToro

eToro is one of the most prominent social investment networks, with a mission to improve investors' knowledge and activity regarding finance. Since its inception in 2007, eToro has become the premier investment platform for novice and experienced traders, with a user base of over 17 million. You can read our full eToro review here.

Security and Privacy

When choosing an investment platform, security is among the biggest factors to consider. Since eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), you can be assured that your funds and personal details are secure. Furthermore, eToro SSL encrypts all submissions to safeguard against hackers trying to intercept confidential information. Finally, the platform has two-factor authentication (2FA) to ensure the users’ accounts are safe.

Fees & Features

Both inexperienced and seasoned investors can take advantage of eToro's extensive library of cutting-edge trading methods. For instance, beginners in trading can take advantage of CopyTrading available on eToro as it allows them to mimic the actions of more experienced traders. Those with trading experience will be glad to find that eToro provides access to many markets, such as stocks, currencies, and cryptocurrency, all from one platform. Also, eToro is a commission-free service. However, the platform charges a monthly fee of £10 for inactivity to promote active trades on the platform.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

| Deposit Fee | £0 |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com, which originated in 2016, is an excellent multi-asset broker. With over 5 million users, it has established itself as a low-cost platform with low overnight fees, tight spreads, and 0% commission. You can read our full Capital.com review here.

Security and Privacy

Capital.com is an FCA, CySEC, ASIC, and NBRB-licensed corporation dedicated to providing the most effective trading experience in the world. It shows that users' data is secured and hidden on Capital.com, since the site follows stringent criteria to achieve this goal. Capital.com takes client data security seriously, and one way it does this is by complying with the PCI Data Security Standards.

Fees & Features

Capital.com offers a wide variety of no-cost brokerage services. Its financial policies are transparent. Any fees you incur will be made clear before you pay them. Capital.com's principal costs come from spread charges, which are often low compared to competitors. The broker's mobile trading app features an AI-powered tool that gives clients personalized trading information by employing a detection algorithm. In addition, Capital.com's multilingual customers can get in touch with a representative via email, phone, or live chat.

| Fee Type | Fee Amount |

| Deposit Fee | £0 |

| Commission Fee | 0% |

| Inactivity Fee | £0 |

| Withdrawal Fee | £0 |

Pros

- Efficient email and chat support

- MetaTrader integration

- Commission-free trading

Cons

- Majorly restricted to CFDs

3. Skilling

Skilling is a multi-asset broker with significant growth. The broker offers excellent trading conditions regarding platform features and products available to experienced traders. Skilling now provides Forex, CFD, Stock, and cryptocurrency trading six years after its inception to individual investors. You can read our full Skilling review here.

Security and Privacy

When looking for a broker like Skilling, it is essential to check the broker's regulatory standing. Skilling is administered by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). In addition, the money that traders deposit into their Skilling accounts is held in a completely independent financial institution. For maximum safety, Skilling only uses top-tier financial institutions for this purpose. Tier 1 capital is the industry benchmark for measuring a bank's soundness.

Fees & Features

Skilling does not charge commissions for trading equities, indices, or cryptocurrencies. The platform charges Spreads which vary based on the share, but are typically very reasonable. Skilling offers two distinct account options for FX and metals CFD trading. The Standard Skill account has significantly larger spreads but no commissions. The Premium account charges commissions on spot metal and FX CFD trades for decreased spreads. Additionally, Skilling provides a demo account, mobile applications, and a trade assistant.

| Fee Type | Fee Amount |

| Commission Fee | £0 |

| Withdrawal Fee | Varies |

| Inactivity Fee | £0 |

| Deposit Fee | £0 |

Pros

- Great platform choice

- Demo accounts

Cons

- High Spreads

- Service is unavailable in many countries, including the US and Canada.

Everything You Need To Know About PharmaMar

Now, let’s take a deep look at PharmaMar, exploring its history and business strategy, how it makes money, and its performance in recent years.

PharmaMar History

PharmaMar was founded in 1986 by José María Fernández Sousa-Faro as a subsidiary of Zeltia with the objective of developing antitumor drugs from marine-based resources such as algae. Zeltia itself was founded in 1939 to produce drugs for the treatment of cardiovascular and metabolic diseases, as well as gynecologic disorders.

PharmaMar achieved its first success in 2001 when it produced trabectedin (ecteinascidin 743 or ET-743), the first drug against cancer developed in Spain. The drug is marketed under the commercial name Yondelis after approval by the European Medicines Agency (EMA) and the Food and Drug Administration (FDA) for the treatment of soft-tissue sarcoma and uterine cancer in advanced stages.

In 2015, PharmaMar absorbed its parent company (Zeltia) and all its subsidiaries through a reverse merger. In 2020, the company became a component of the Madrid Stock Exchange General Index (IGBM) and the IBEX 35 Index, an index of the top 35 companies in Spain.

What Is PharmaMar’s Strategy?

PharmaMar researches, develops, produces, and markets bio-active substances of marine origin for use in oncology, as well as therapies that are based on gene silencing. The company also develops and markets diagnostics kits for gene analysis and paternity testing. Its strategy is based on robust research and development, with an emphasis on oncology, genetic testing, and gene therapy.

The company’s strategy of concentrating on its oncology business and focusing on marine origin is what differentiates it from other biotech companies. It is one of the few firms on the planet dedicated exclusively to isolating and extracting new medicinal compounds from marine organisms such as algae.

How Does PharmaMar Make Money?

PharmaMar makes money from the sale of its products, which include oncology drugs of marine origin, diagnostics kits for gene analysis and paternity testing, and RNA interference therapy. Thus, the company categorizes its business into three segments: oncology, diagnostics, and RNA interference.

However, most of its revenues come from marketing these oncology drugs: Yondelis, which is approved for the treatment of soft tissue sarcomas and ovarian cancer; Aplidin, approved for the treatment of multiple myeloma; and Zepzelca, approved for treating patients with small cell lung cancer.

How Has PharmaMar Performed in Recent Years?

The stock’s performance over the years has been mixed. It declined from an all-time high of €317.40 in October 2000 to around €15 in 2012/2013 and remained stagnant below €50 until 2020. It finally broke the €50 in February 2020 and made a serious attempt at recovery, reaching as high as €148 in October 2020. However, since the beginning of 2021, the stock has been on a deep, multi-legged pullback. As of October 6, 2021, the stock trades around €70.44, which is more than 50% lower than its October 2020 high.

Source: Yahoo! Finance

Where Can You Buy PharmaMar Stock?

Buying the real stock from a stockbroker gives you part ownership in the company, unlike trading the CFD or spread betting, which is just for speculating on the price movements of the stock — however, some major CFD vendors also allow you to buy real stocks.

Since PharmaMar trades on the Spanish Stock Exchange, you can buy the stock from international stockbrokers with access to that stock exchange. While most of those brokers offer only standard share dealing account types, UK-based ones may also offer the tax-friendly shares ISA and SIPP accounts. It’s also possible to buy PharmaMar DR from some major commercial banks with a share dealing arm in your country of residence.

PharmaMar Fundamental Analysis

Fundamental analysis is a method you use to get the intrinsic value of a stock by studying the company’s business and how it makes money. Some of the factors to consider when performing fundamental analysis of a stock include the P/E ratio, revenue, earnings-per-share, dividend yield, and cash flow, which we will explain below.

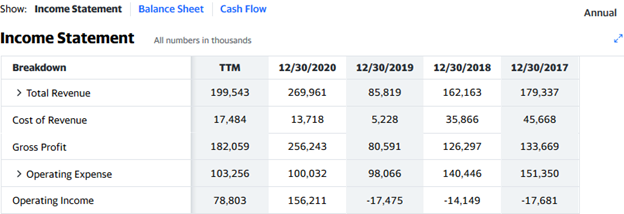

PharmaMar’s Revenue

The revenue of a company, which is also referred to as the top line, is the amount of money it generates from the sales of its products or services before any costs have been deducted to get the profits (earnings). When a company records a higher revenue compared to the preceding quarter or a similar period in the preceding year, the stock price is likely to perform better.

For the 2020 fiscal year, which ended December 30, 2020, PharmaMar recorded a revenue of about 270 million EUR, which represents a 214% growth when compared to 2019’s revenue of about 86 million EUR.

Source: Yahoo! Finance

PharmaMar’s Earnings-per-Share

Earnings refer to the profit a company makes within an accounting period after all costs of doing business have been deducted from its revenues. It is usually referred to as the “bottom line” because it is placed in the bottom line of the income statement.

As an investor with only a few shares in the company, you should be more interested in earnings per share (EPS), which shows the amount the company earned for each outstanding share of its common stock, rather than the total earnings.

You can calculate PharmaMar’s EPS by dividing its net earnings (less the dividends paid to preferred stockholders) by the number of common shares outstanding. But you don’t need to; the metric is usually available on stockbrokers’ websites or any major financial website. PharmaMar’s EPS for the 2020 fiscal year was €7.50.

PharmaMar’s P/E Ratio

A company’s price-earnings (P/E) ratio compares its share price to its earnings-per-share, and it is calculated by dividing the current share price by the EPS.

For example, given PharmaMar’s share price of €70.44 and EPS of €7.50, the P/E ratio would be about 9.39. This means that as of October 6, 2021, investors are willing to pay €9.39 for every euro the company earns in profits per annum.

While stocks with very high P/E ratios are usually considered overvalued and those with low ratios are considered undervalued, there is no cutoff level for the P/E ratio to know which is high or low. Moreover, it does not factor in earnings growth, which is why the PEG ratio might be a better metric.

PharmaMar’s Dividend Yield

Dividends are a portion of a company’s earnings distributed to its shareholders to reward them for investing in the company. Cash dividends are usually paid quarterly, semi-annually, or annually. PharmaMar pays annual dividends, and for the 2020 fiscal year, it paid a dividend of €0.60 per share. When a company declares dividends, its share price rises until after the ex-dividend date and then declines.

A dividend yield is a company’s total annual dividends expressed as a percentage of its share price. For example, if a company’s annual dividend is €0.60 per share when its share price is €70.44, its dividend yield would be 0.85%. You can do the calculation yourself, but you don’t have to, since the dividend yield is often seen alongside other financial ratios on the stockbroker’s website or any of the major financial websites.

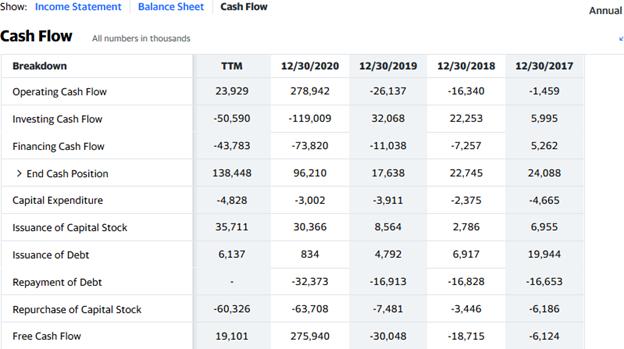

PharmaMar’s Cash Flow

The cash flow statement is a record of how money flows in and out of a business. It is one of the three financial statements you study when analysing a company, and you will see it beside the other financial statements in the financial section of the company’s information on a broker’s website or any of the major financial websites.

The key information in the cash flow statement is the free cash flow, which represents the amount of cash or cash equivalents left after paying for major expenses necessary for running the business, such as building, equipment, and other bills. In PharmaMar’s cash flow statement below, you can see that the company had over €275 million in free cash as of the end of 2020. That is cash the company has to fund expansion, pay dividends, or pay down debts.

Source: Yahoo! Finance

Why Buy PharmaMar Stocks?

After years of quietly building, researching, and developing new drugs, PharmaMar has started making profits. With the way the company is improving its key financial metrics, it might be a great stock for investors who love growth stocks. The company grew its revenue by more than 200% in one year, while its EPS jumped from -€0.60 in 2019 to €7.50 in 2020.

Here are three reasons you might want to buy PharmaMar stock:

- PharmaMar's EPS is growing year on year.

- The company pays dividends.

- The share price seems to be recovering after years of stagnation.

Expert Tip on Buying PharmaMar Stock

“ Looking at the stock’ price chart, you can see a visible head and shoulder pattern, which might suggest a further price decline. So, it may not make sense to place a limit order to avoid sitting in the way of a falling knife. You may want to wait for the price to reverse first and then enter on a breakout of a local swing high. ”- willfenton

5 Things to Consider Before You Buy PharmaMar Stock

These are five things to consider before you buy PharmaMar stock:

1. Understand the Company

There may not be anything wrong with investing in a company you are familiar with and use its products and services, but you must first study the company’s fundamentals to be sure that it is making money before you commit your hard-earned cash.

Things to study include the company’s business model and how it makes money. You should also check the earnings history to know if earnings are growing. It pays to know what the company does with its free cash — distribute it to shareholders as dividends, buy back stocks, expand its business, or squander it on multiple corporate jets and oversized expenses.

2. Understand the Basics of Investing

What do you know about investing? It is necessary to learn the basic terminology so you can read financial statements and understand what financial analysts say when they use certain terms. Reading the resources on our various pages would certainly help you, but you can also check financial dictionaries for terms you don’t understand.

Beyond the terminology, you should learn how orders are executed. Also, ensure you learn money management and risk management techniques, as well as diversification strategies.

3. Carefully Choose Your Broker

Things to consider when choosing a broker include the broker’s asset offerings, supported order types, trading commissions, trading platforms (desktop, web, or mobile), payment methods, and customer support service. But, more importantly, be sure the broker is regulated in your country of residence so as to ensure the safety of your funds. Apart from the broker not being able to run with your money, you would qualify for any insurance scheme in your country.

4. Decide How Much You Want to Invest

While you can budget for your investment, ensure you invest only what you can afford to lose. Avoid using borrowed funds, including the leverage offered by your broker — as a beginner, avoid leverage until you gain experience because it can magnify losses. When you have saved the money to invest, decide the percentage to commit to one stock and also plan how to buy whichever stock you want to buy. Scaling in gradually using dollar-cost averaging is better than making a lump-sum investment.

5. Decide on a Goal for Your Investment

Find out what you hope to achieve with the investment — it could be that you want to raise money for your kid’s college, plan for a future project, or build your pension fund for retirement. Also, you should know how long you want to hold the investment and when to sell to recover your money. It could be when the price gets to a particular level, when you or your kid reach a particular age, or when the fundamentals are weak. You may also want to hold indefinitely and sell when you need the money.

The Bottom Line on Buying PharmaMar Stocks

PharmaMar is a Spanish biotech company that researches, develops, produces, and markets bio-active substances of marine origin for cancer treatment, as well as therapies based on gene silencing and diagnostics kits for gene analysis and paternity testing. You may want to invest in this stock to benefit from its growth potential, and you can do that via a stockbroker with access to the Spanish stock exchange.

If you’re ready to invest in PharmaMar stock right now, sign up for a stockbroker’s share dealing account and look for the stock in the list of stocks. Then, click the “buy” button to buy at a quoted price or place a limit order to buy at the price you want.

If you’re not ready to invest right now, keep reading other guides on our website to learn more about investing. Paper trading using a stockbroker’s demo account may also be helpful at this point.

Frequently Asked Questions

-

Gene silencing, sometimes referred to as gene knockdown, is a way of regulating the expression of certain genes to reduce their influence. In other words, when a gene is silenced, its expression is reduced. This process is being increasingly used to produce therapeutics to combat cancer and other diseases, such as infectious diseases and neurodegenerative disorders.

-

RNA interference, or RNAi for short, is a method of gene silencing that targets the RNA — molecules the cell uses to decode the information in the DNA. The process of RNA interference is highly technical, but the key thing is that it is used to suppress gene expression and is being employed in the treatment of certain diseases.

-

A company’s revenue is called the top line because it is placed at the top of the income statement. It is the first item you see in the income statement before you begin to see the cost of sales and all other expenses. The revenue tells you how much the company realized from the sale of its product or services.

-

The PEG ratio (price/earnings-to-growth ratio) is a growth-adjusted P/E ratio. It is derived by dividing a company's P/E ratio by the growth rate of its earnings for a given period, say three years. The ratio takes into account the expected growth rate of the company’s earnings per share.

-

In technical analysis, the head and shoulder pattern is a chart pattern that indicates a potential bearish mood in the market. It consists of three swing highs, with the middle one being higher than the others. This pattern indicates that the downward price movement after the third swing high may not just be another pullback but a potential downward price reversal.

-

Commit only a small fraction (5% or less) of your trading capital in each trade so that if the trade ends in a loss, you would still have enough capital to trade with. Also, make sure you always set a stop-loss order to limit your loss to only the amount you staked. You can also diversify your investment across different asset classes.