How to buy Tryg stocks in 2024

Formerly TrygVesta, Tryg is a Danish multinational insurance company that provides insurance services for private and corporate customers in Nordic countries, including Denmark, Norway, Sweden, and Finland. It is the parent company within the Tryg Group, which is the second-largest insurance provider in the Scandinavian region, offering all kinds of insurance products including car, accident, travel, motorcycles, pet, health, property, group life, and boat insurance.

The stock is listed on Nasdaq OMX Copenhagen. This guide tells you how you can buy Tryg stock with confidence, and why you might want to, taking various fundamental factors into account.

How to Buy TGVSF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Tryg Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need To Know About Tryg

At this point, let’s get to know Tryg in more detail by exploring its history, business strategy, and how it has performed in recent years.

Tryg History

TrygVesta was formed in 2002 through the merger between Tryg Forsikring and Nordea's insurance groups. However, Tryg Forsikring traces its history back to 1731 when Kjøbenhavns Brandforsikring was founded.

On the 14th of October 2005, TrygVesta stock was listed on the OMX Nordic Stock Exchange Copenhagen, and in December, it became a component of the OMXC20 Index — an index of the 20 most traded shares on the OMX Nordic Stock Exchange Copenhagen.

TrygVesta launched its first Swedish branch, Vesta Skadeförsäkring in June 2006. In April 2009, it completed the acquisition of the Swedish insurance company, Moderna Försäkringar, making Moderna a part of TrygVesta. In August 2010, TrygVesta simplified its name to Tryg.

On the 1st of June 2021, Tryg and the Canadian insurer, Intact Financial Corporation, completed the acquisition of the RSA Insurance Group. Intact retains RSA's Canada and UK & International operations and obligations; Tryg retains RSA's Sweden and Norway operations; and Intact and Tryg co-own RSA's Denmark operations.

What Is Tryg’s Strategy?

Tryg and its subsidiaries offer insurance products and services to private and corporate customers, including small and medium-sized businesses, in Denmark, Norway, and Sweden. Its marketing strategy includes selling its products via call centres, the Internet, franchisees, interest organizations, tied agents, car dealers, real estate agents, and insurance brokers.

The company’s corporate strategy is based on three strategic pillars — sustainable insurance, responsible company, and green workplace — and for each strategic pillar, it has set targets for monitoring progress and measuring impact.

How Does Tryg Make Money?

As with any insurance company, Tryg makes money from the premiums it charges for its insurance products and services, which include car, house, accident, travel, motorcycles, pet, health, property, contents, liability, transportation, group life, and boat insurance, as well as fire, and worker compensation insurance.

The company organizes its business into four segments: private, commercial, industry, and Sweden. The private segment sells insurance products to private individuals in Denmark and Norway, while the commercial segment sells to small and medium-sized companies in the same countries.

The industry segment sells to industrial customers under the Tryg brand in Denmark and Norway and the Moderna brand in Sweden. The Sweden segment, under the Moderna brand name, sells insurance products to private individuals in Sweden.

How Has Tryg Performed in Recent Years?

Since it made its debut in 2005, the share price has more than quadrupled. But this wasn’t without some hiccups along the way. After the initial ascent between 2005 and 2007, the stock steadily declined until the second half of 2011 when it started its latest bull run.

The stock made a swift ascent from about DKK 50 to over DKK 169 between 2011 and 2015 before making a deep pullback to DKK 120 in 2016. It then rose again, reaching its all-time high of DKK 226.40 in 2019. Since then, the stock has been in another deep pullback and trading sideways within the DKK 138-DKK 160 range.

Source: Yahoo! Finance

Where Can You Buy Tryg Stock?

When you buy the shares of a company through a stockbroker, you have part ownership of the company; this is different from speculating on the company’s share price movement by placing a CFD trade or spread bet.

Thus, if you want to own Tryg shares, you buy the stock via a stockbroker with access to Nasdaq OMX Copenhagen where it trades, rather than via one of the popular CFD trading platforms — although some CFD providers also allow you to buy stock.

Many stockbrokers offer just the standard share trading accounts, but UK-based brokers also offer tax-efficient retirement fund accounts, such as the shares ISA and SIPP accounts. Your bank may have a share dealing arm through which you can buy Tryg DR.

Tryg Fundamental Analysis

Fundamental analysis is a method of evaluating a stock by studying the company’s business to know the stock’s intrinsic value. There are many factors investors consider when evaluating a stock using fundamental analysis, and some of them, such as corporate management and goodwill, are not measurable. In this guide, we will focus on the measurable financial metrics, such as the company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow.

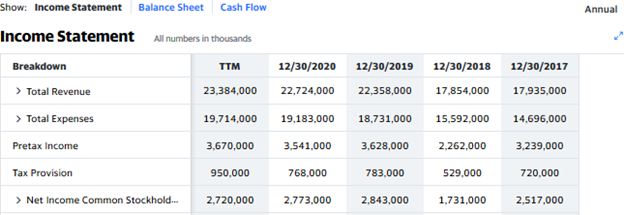

Tryg’s Revenue

Revenue is the first item you see at the top of an income statement. It represents the amount of money a company generates from the sales of its products or services before any costs have been deducted.

Investors like to compare the revenue figures to that of the preceding quarter or a similar quarter in the preceding year to know whether the company is growing its revenue. The higher the revenue growth, the better. For the 2020 fiscal year, which ended December 30, 2021, Tryg recorded revenue of DKK 22.724 billion. This represents a 1.64% growth from the 2019 revenue of DKK 22.358 billion.

Source: Yahoo! Finance

Tryg’s Earnings-per-Share

Earnings are profits left for a company after all costs of doing business have been deducted from the revenue. Dividing the net profit (less the dividends paid to preferred stockholders) by the number of common shares outstanding gives you the earnings per share (EPS), which is what should concern you as a shareholder.

EPS is the amount a company earned for each outstanding share of its common stock during the period under review. Since EPS is readily available on your stockbrokers’ websites or any financial website, you don’t need to calculate the value yourself. Tryg’s EPS for the 2020 fiscal year is DKK 7.15.

Tryg’s P/E Ratio

The price-earnings (P/E) ratio is a financial metric used to compare a company’s share price to its earnings-per-share. To get the value, you divide the company’s current share price by its EPS. For example, given Tryg’s share price of DKK 149.600 DKK and EPS of DKK 7.15, its P/E ratio would be about 20.92. This means that investors are ready to pay DKK 20.92 DKK for every Danish krone Tryg earns in profits.

Generally, if a company’s P/E ratio is very high, investors consider the stock overvalued, but they still continue to buy the stock if they anticipate bigger earnings in the future. This is why the PEG ratio, which also considers expected earnings growth, may be a better metric than the simple P/E ratio.

Tryg’s Dividend Yield

Dividends are payments made by companies to their shareholders to reward them for investing in their companies. Some companies pay dividends quarterly, semi-annually, or annually. Anytime dividends are declared, the share price rises until the ex-dividend date, and then, it declines.

The dividend yield compares the total annual dividends a company pays to its share price; it expresses the dividend as a percentage of the stock price to give you an idea of the returns. For example, Tryg paid out a total annual dividend of DKK 7.0 per share in the 2020 fiscal year. Given its share price of DKK 149.600, the dividend yield would be 4.68%.

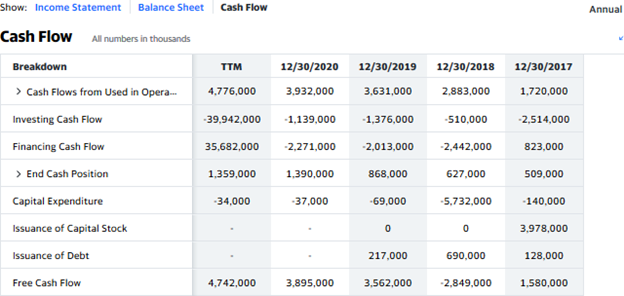

Tryg’s Cash Flow

The cash flow statement is one of the three financial statements a company keeps. You can find it alongside the other financial statements in the financial section of the company’s information on a broker’s website or any of the major financial websites.

When analysing the cash flow statement, your interest should be on the free cash flow figure, which shows the amount of cash and cash equivalents a company has left after taking care of major expenses, such as building, equipment, and other bills, necessary for running its business. It’s the free cash that tells you how much cash the company has to pay dividends or fund expansion projects.

In Tryg’s cash flow statement for the 2020 fiscal year below, you can see that the company had about DKK 3.9 billion in free cash as of December 30, 2020.

Source: Yahoo! Finance

Why Buy Tryg Stocks?

Tryg is Denmark's No. 1 insurance group and the second largest in the whole of the Nordic region. The company has a long history of business success in Denmark that spans over 300 years. Surviving and thriving for that long shows a company that continually adapts itself to the changing needs of different generations. It continues to expand and grow by making astute acquisitions.

These are the top three reasons you might want to buy Tryg stock:

Tryg has been around and thriving for many years.

The company continues to grow and acquire good businesses.

It has a long history of paying dividends.

Expert Tip on Buying Tryg Stock

“ Since the middle of 2020, the stock has been trading sideways within a small range — between DKK 138 and DKK 160. There are two ways to trade this: you can trade the range, in which case you wait to buy at the low point of the range and sell at the upper boundary, or you wait for the stock to break above the upper boundary of the range and ride the momentum. ”- willfenton

5 Things to Consider Before You Buy Tryg Stock

You need to consider these factors before you buy any stock:

1. Understand the Company

Before you invest your money in any stock, make sure you understand the company and its products or services. While some seasoned investors such as Peter Lynch suggest that you should invest in companies whose products and services you use yourself, it is not enough if you ignore the financial fundamentals. That you use a company’s products or services does not automatically make it a good investment. Find out how it makes money, its growth plans, and the track record of its management team.

2. Understand the Basics of Investing

You need to learn the basics of investing first before committing your money to any stock. This would help you reduce your chances of making a mistake and losing your money. Learn about risk management, money management, and diversification. While risk management and money management helps you to control how much you lose if the market goes against your position, diversification is all about spreading your risk across several stocks or even asset classes.

3. Carefully Choose Your Broker

Choosing the right broker is critical to your investing journey. Look for a broker that charges low commission fees and offers intuitive trading platforms and apps. But, most importantly, the broker must be licensed by the financial services regulator in your country of residence to ensure the safety of your money; it also allows you to benefit from any financial compensation scheme in your country if the broker becomes insolvent.

Other factors to consider before choosing a broker include supported order types, payment methods, customer support service, provided trading tools, and education and research tools.

4. Decide How Much You Want to Invest

Ensure you don’t invest more than you can afford to lose. Use only your disposable income, not the money you need to pay bills. As a beginner, avoid using leverage until you gain enough experience — leverage can magnify your losses.

When you have saved up money to invest, determine the percentage of your capital you will allocate to one stock. You should also determine how you want to invest the money — while you can invest a lump sum at once, you might want to practice dollar-cost-averaging and scale in gradually. Dollar-cost averaging helps you to use market volatility to your advantage.

5. Decide on a Goal for Your Investment

You must have an investment goal. This can guide your investment decision and helps you ascertain how long you may want to hold your investment. For example, if you are investing to build your pension fund for retirement, you may want to sell when you reach a particular age. Likewise, if you are investing to raise money for your kid’s college, you may want to sell when your kid reaches a certain age or gains a college admission.

The Bottom Line on Buying Tryg Stocks

Tryg is a Danish multinational insurance company that provides insurance services for private and corporate customers in Denmark, Norway, Sweden, and Finland. You might want to invest in this stock if you want regular income from dividends. The stock can be bought from any stockbroker with access to Nasdaq OMX Copenhagen.

If you’re ready to invest in Tryg stock right now, you need to sign up for a stockbroker’s share dealing account, find Tryg in its categorised list of stocks, and place an order to buy at a quoted price (a market order) or the maximum price you’re willing to pay (a limit order).

If you’re not ready to invest right now, you can continue to read other guides on our website to gain more knowledge about investing. You may also start by “paper trading” using a stockbroker’s demo account to learn how the market works.

Frequently Asked Questions

-

Sustainable insurance refers to a strategic approach an insurance firm can adopt. It entails performing all activities in the insurance value chain, including interactions with stakeholders, in a responsible and forward-looking way. It also involves identifying, assessing, managing, and monitoring risks and opportunities associated with environmental, social, and governance issues.

-

This is a type of life insurance where a single contract covers an entire group of people. In most cases, the policy owner is an employer, an institution, or an entity (for example, a labor organization), so the insurance covers the employees or members of the group.

-

A merger is an agreement between two companies to form a new company. There are several reasons why companies merge, but the common ones are to expand a company’s geographical reach, gain market share, or expand into new segments. Ultimately, it’s all about increasing shareholder value.

-

A stop-loss order is a pending order you place with a broker to sell (if you have a long position) or buy (if you have a short position) a stock when the price reaches a certain level against your position. You can use it to keep your loss to an amount you are willing to lose when the market moves unfavourably in your absence.

-

A trailing stop is an automated stop-loss order that moves along with the price when it moves in a favourable direction. Although the order moves along with the price when it is moving in a favourable direction, it stays at the last level it got to when the price reverses and closes your trade when the price hits it.

-

You can do this manually by moving your stop-loss order along to lock in profits as the price moves in your favour. A better option is to use a trailing stop order which is automated and moves along with the price when it is moving in a favourable direction (by the distance you set away from the current price level).