How to buy Royal Dutch Shell stocks in 2026

This guide tells you where and how you can invest in Royal Dutch Shell stock, and why you might want to do so from a mainly fundamental analysis perspective.

How to Buy SHEL Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Best Reviewed Brokers to Buy Royal Dutch Shell Stocks

1. eToro

eToro is one of the most prominent social investment networks, with a mission to improve investors' knowledge and activity regarding finance. Since its inception in 2007, eToro has become the premier investment platform for novice and experienced traders, with a user base of over 17 million. You can read our full eToro review here.

Security and Privacy

When choosing an investment platform, security is among the biggest factors to consider. Since eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), you can be assured that your funds and personal details are secure. Furthermore, eToro SSL encrypts all submissions to safeguard against hackers trying to intercept confidential information. Finally, the platform has two-factor authentication (2FA) to ensure the users’ accounts are safe.

Fees & Features

Both inexperienced and seasoned investors can take advantage of eToro's extensive library of cutting-edge trading methods. For instance, beginners in trading can take advantage of CopyTrading available on eToro as it allows them to mimic the actions of more experienced traders. Those with trading experience will be glad to find that eToro provides access to many markets, such as stocks, currencies, and cryptocurrency, all from one platform. Also, eToro is a commission-free service. However, the platform charges a monthly fee of £10 for inactivity to promote active trades on the platform.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

| Deposit Fee | £0 |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com, which originated in 2016, is an excellent multi-asset broker. With over 5 million users, it has established itself as a low-cost platform with low overnight fees, tight spreads, and 0% commission. You can read our full Capital.com review here.

Security and Privacy

Capital.com is an FCA, CySEC, ASIC, and NBRB-licensed corporation dedicated to providing the most effective trading experience in the world. It shows that users' data is secured and hidden on Capital.com, since the site follows stringent criteria to achieve this goal. Capital.com takes client data security seriously, and one way it does this is by complying with the PCI Data Security Standards.

Fees & Features

Capital.com offers a wide variety of no-cost brokerage services. Its financial policies are transparent. Any fees you incur will be made clear before you pay them. Capital.com's principal costs come from spread charges, which are often low compared to competitors. The broker's mobile trading app features an AI-powered tool that gives clients personalized trading information by employing a detection algorithm. In addition, Capital.com's multilingual customers can get in touch with a representative via email, phone, or live chat.

| Fee Type | Fee Amount |

| Deposit Fee | £0 |

| Commission Fee | 0% |

| Inactivity Fee | £0 |

| Withdrawal Fee | £0 |

Pros

- Efficient email and chat support

- MetaTrader integration

- Commission-free trading

Cons

- Majorly restricted to CFDs

3. Skilling

Skilling is a multi-asset broker with significant growth. The broker offers excellent trading conditions regarding platform features and products available to experienced traders. Skilling now provides Forex, CFD, Stock, and cryptocurrency trading six years after its inception to individual investors. You can read our full Skilling review here.

Security and Privacy

When looking for a broker like Skilling, it is essential to check the broker's regulatory standing. Skilling is administered by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). In addition, the money that traders deposit into their Skilling accounts is held in a completely independent financial institution. For maximum safety, Skilling only uses top-tier financial institutions for this purpose. Tier 1 capital is the industry benchmark for measuring a bank's soundness.

Fees & Features

Skilling does not charge commissions for trading equities, indices, or cryptocurrencies. The platform charges Spreads which vary based on the share, but are typically very reasonable. Skilling offers two distinct account options for FX and metals CFD trading. The Standard Skill account has significantly larger spreads but no commissions. The Premium account charges commissions on spot metal and FX CFD trades for decreased spreads. Additionally, Skilling provides a demo account, mobile applications, and a trade assistant.

| Fee Type | Fee Amount |

| Commission Fee | £0 |

| Withdrawal Fee | Varies |

| Inactivity Fee | £0 |

| Deposit Fee | £0 |

Pros

- Great platform choice

- Demo accounts

Cons

- High Spreads

- Service is unavailable in many countries, including the US and Canada.

Everything You Need To Know About Royal Dutch Shell

Let’s take a deep dive into the Royal Dutch Shell company to learn about its history, business strategy, revenue streams, and recent share price performance.

Royal Dutch Shell History

Royal Dutch Shell Group was created in April 1907 when the Netherlands’ Royal Dutch Petroleum Company the UK’s Shell Transport and Trading Company merged in 1907 in response to the dominance of John D. Rockefeller’s Standard Oil company. Although the two companies operated as a single-unit partnership for business purposes, they had separate legal existences. The Dutch company was in charge of production and manufacture, and the UK company directed the transportation and storage of the products.

After it was revealed that Shell had been overstating its oil reserves, the company was moved to a single capital structure to create a new parent company called Royal Dutch Shell plc with a primary listing on the London Stock Exchange and a secondary listing on the Amsterdam Stock Exchange. Royal Dutch shareholders got 60% of the company, which was in line with the original Shell Group ownership.

What is Royal Dutch Shell’s Strategy?

Shell launched its Powering Progress strategy in February 2021 to accelerate the transition of its business to net-zero emissions.

The intention was to build a strong and resilient customer-centric business with innovative products and solutions to help customers get to net-zero. As part of this, the company would partner with other organisations in hard-to-decarbonise sectors and would aim to deliver value by integrating the assets and supply chains involved in the production, purchase, trading, transportation, and selling of energy products worldwide.

The Powering Progress program has four main goals:

Generating shareholder value by distributing dividends and taking a disciplined approach to capital investment.

Achieving net-zero emissions by 2050 through selling low-carbon products (e.g., biofuels), generating electricity from solar and wind sources, and harnessing hydrogen and electricity for powering vehicles.

Powering lives by providing homes, businesses, and transport with reliable and sustainable energy while supporting livelihoods by providing employment and training in the communities where the company operates.

Respecting nature, including protecting and enhancing biodiversity, focusing on using (and reusing) water and other resources more efficiently, recycling plastic, and improving air quality.

How Does Royal Dutch Shell Make Money?

This company has historically made money from the production, manufacture, transportation, and storage of fossil fuels. You will no doubt have seen Shell-branded fuel stations in the UK, Europe, and around the world. Nowadays, Shell is trying to transition to a greener future where fossil fuels are replaced by renewable energy sources.

In 2020, over 60% of revenues came from the Oil Products business segment. Almost 16% came from Integrated Gas, more than 13% came from the Upstream segment, and about 7% could be attributed to Chemicals. It is clear that the company has a long way to go to decarbonise its offerings.

How Has Royal Dutch Shell Performed in Recent Years?

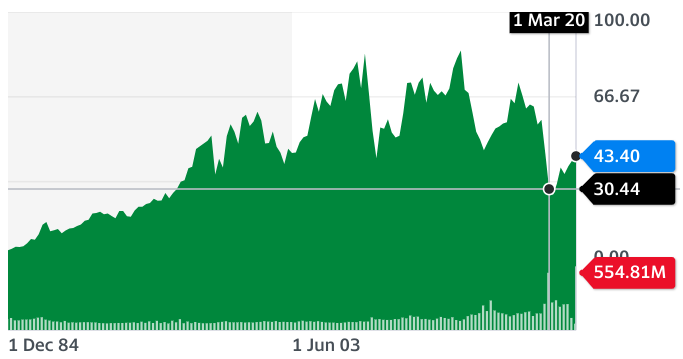

The following chart shows how — after an initial bull run — Royal Dutch Shell shares have experienced a roller coaster ride in recent decades. Having reached a price peak in 2014, the shares then fell back to a local low point following the coronavirus pandemic crash of March 2020. At the end of September 2021, they looked to be recovering, but volatility is still a big feature of the share price performance.

Where Can You Buy Royal Dutch Shell Stock?

You can buy Royal Dutch Shell “A” shares and “B” shares on the London Stock Exchange, and the Amsterdam Stock Exchange, and also via listings on the New York Stock Exchange. You won’t interact with those exchanges directly as a retail investor, so you’ll need to use a broker with access to at least one of those exchanges. There are many brokers to choose from, and we have some suggestions, but the main thing is to choose a broker that is properly regulated in your country.

Royal Dutch Shell Fundamental Analysis

There are two schools of investment thought: fundamental analysis (or “assessing a company’s true value”) and technical analysis (or “predicting price changes from patterns on charts”). Let’s look at Royal Dutch shell as a potential investment from a fundamental perspective.

Royal Dutch Shell’s Revenue

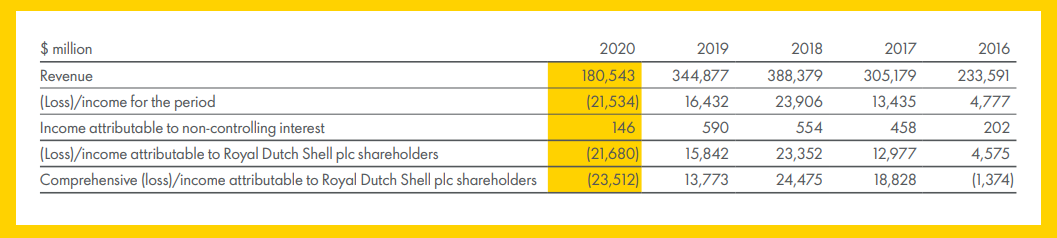

A company's revenue is the total amount of income produced from the sale of its goods and services. The revenue figure is usually found at the head of a company’s profit and loss (income) statement, hence it is often referred to as the “top line”. Year-over-year revenue growth is regarded as a good thing, so it's unfortunate that this company’s revenue almost halved in 2020 as a result of the coronavirus crises that caused cars not to be driving and aircraft not to be flying. On the plus side, as the recovery continues, revenues could double from 2021 onwards.

Royal Durch Shell Income Statement 2020 (source: company website)

Royal Dutch Shell’s Earnings-per-Share

Whereas revenue is referred to as the “top line” of a business’s income statement, the earnings (or profits) are usually known as the “bottom line”, and they’re calculated by deducting all the company’s costs from its revenues. Unfortunately the bottom line for RDS has recently been bad.

Due to the global pandemic problems, the company’s 2020 earnings were negative at about -$21 billion, which means it made a big loss. The earnings-per-share figure for was therefore also negative at -$2.78, down from +$1.97 in 2019.

Royal Dutch Shell’s P/E Ratio

The price-earnings (P/E) ratio indicates the share price you pay for a company’s earnings. It’s natural that an investor will want to pay a low price for a lot of earnings, so stocks with lower P/E ratios are generally regarded as more attractive than stocks with higher P/E ratios. Beware, though, that a company could temporarily have a low P/E because its share price has fallen far, and another company could have a high P/E that is justified by an anticipated massive increase in earnings.

Since RDS reported negative earnings in 2020, it’s P/E would also be negative. However, in October 2021, financial websites are reporting a trailing-twelve-months (TTM) P/E of 31.24, which is three times that of rival BP. On this measure, BP is therefore the better buy.

Royal Dutch Shell’s Dividend Yield

Investors do not directly benefit from a company’s earnings unless they’re paid out in the form of dividend distributions, but the ones that don’t are able to plough their earnings back into the business to (hopefully) boost the share price.

A stock’s dividend yield is its dividend amount expressed as a percentage of the share price. This percentage can be compared with the interest you’d receive if you put your money into a bank deposit account instead.

Having paid dividends at a steady rate of $1.88 per share in 2016 through 2019, the 2020 dividend payout fell by two-thirds to $0.65. At the start of October 2021, financial websites were reporting a forward dividend of $0.54 and a forward dividend yield of 3.28%, which is competitive compared with the interest rates available on bank deposit accounts.

Royal Dutch Shell’s Cash Flow

A company's cash flow refers to net cash flowing into and out of a business during a defined period. A sustainable and constant positive cash flow indicates that the company can meet its short-term obligations, whereas consistently negative or fluctuating cash flow suggests that the company may eventually run out of cash.

Although Shell's free cash in 2019 and 2020 was 30%-40% lower than its peak in 2017, it was positive, and that's the main thing.

Why Buy Royal Dutch Shell Stocks?

From the final quarter of 2021 onwards, the world seems to be facing energy crises of one form or another — from rising natural gas prices to queues at UK fuel stations in September. Despite the push towards renewable energy sources, 2021-2022 could be a good time to be invested in oil companies if the energy crisis truly goes global.

As alluded to earlier, in late 2021, this stock’s share price appeared to be in an uptrend from a near all-time low, so it could be attractive from a technical as well as economics-driven fundamental perspective.

Expert Tip on Buying Royal Dutch Shell Stock

“ Although there are two types of Royal Dutch Shell shares (RDS-A and RDS-B), they confer the same rights and are priced pretty much the same, unlike a company such as Warren Buffett’s Berkshire Hathaway that has much more affordable “B” shares for investors who can’t afford to buy even a single “A” share. UK investors intending to buy Royal Dutch Shell shares are advised to go for the B shares because the dividends are taxed more favourably due to differences in the UK and Netherlands tax systems. ”

5 Things to Consider Before You Buy Royal Dutch Shell Stock

1. Understand the Company

It’s important to understand all aspects of the company you intend to invest in, and this guide should be of great help to you in terms of learning what the company does, how it makes money, and how it has been performing as a prospective investment. Some successful investors get to know a company — or rather, its stock — by making a small initial investment before going all-in, to get a feel for how the share price typically behaves.

2. Understand the Basics of Investing

The investing world is full of jargon, and you might often hear words such as bulls, bears, black swans, and cash cows. That’s only the animal analogies, and not all of them.

You read about financial instruments such as stocks/shares (or equities), exchange-traded funds (ETFs), mutual funds, fixed-income bonds, options, spread bets, contracts for difference (CFDs) and a lot more besides. So, do you know what these terms mean? Do you know the meaning of the terms “bid-ask spread” and how it can affect your investment returns, and do you know the difference between a stop order and a limit order for entering or exiting an investment automatically.

Whatever your starting point may be, you can educate yourselves about markets and investing by reading other guides on our website, of which this is only one.

3. Carefully Choose Your Broker

To trade or invest, you’ll need a broker, which these days will be an online broker. However, the kind of broker you choose will depend on what financial assets you’re looking to trade. For example, whereas a specialist foreign exchange (forex or fx) brokerage might be right for day-trading currencies, it won’t be the right choice if you want to invest in stocks for the long term.

Day traders typically look for a broker with fast execution speeds, low spreads, and lots of technical indicators on price charts. Investors may be more interested in access to company annual reports and special kinds of long-term tax-efficient accounts such as the UK’s Stocks ISA and Self-Invested Personal Pension (SIPP).

We provide plenty of broker reviews and head-to-head comparisons to help you make your choice.

4. Decide How Much You Want to Invest

Don’t take the advice “Only invest what money you can afford to lose”. With that mindset, if you think you can afford to lose a lot of money because you have a high-paying job, you probably will. Therefore, a better way of phrasing this is to say, “Only invest with discretionary or disposable income”, which means money you don’t need right now and won’t need in the near future to pay for such essentials as food and rent.

Once you know how much money you can afford to invest, you can decide how to introduce that money into the markets: whether “all at once” or via the “dollar-cost-averaging” drip-feed approach. Even if you invest all your money at once, which is rarely a good idea, you should never invest it all in a single stock that could go bust and bring down your whole portfolio. Read about diversifying across several assets, and also about managing downside risk by using stop orders to limit losses or lock in profits.

5. Decide on a Goal for Your Investment

“If you fail to plan, you plan to fail.”

“If you don’t sell when you want to, you’ll end up selling when you have to!”

It’s worth keeping these two things in mind when investing. Making a plan for how long you intend to hold your investments is important, and making sure that you can wait that long before getting your money back (and more) is equally important. Therefore, you should decide whether your investment goal is to fund your kids’ college educations, build a retirement pension pot, or just to have some short-term fun by pitting your wits against the market.

The Bottom Line on Buying Royal Dutch Shell Stocks

Royal Dutch Shell is a competitor to rival British petroleum company BP. Like BP, this former fossil fuels company is trying to reposition itself as a vanguard for a sustainable future. Although RDS is a less attractive investment option than BP on some measures such as P/E and dividend yield, it does have the following things going for it:

- The company has a “progressive” strategy.

- It has a positive cash flow.

- It pays dividends.

Frequently Asked Questions

-

Royal Dutch Shell shares are listed on the London Stock Exchange (ticker symbols RDSA and RDSB) and the Amsterdam Stock Exchange (ticker symbol RDSA). You may also find secondary listings on other exchanges such as the New York Stock Exchange (ticker symbols RDS-A and RDS-B).

-

Yes, this stock pays dividends, but the tax treatment of the “A” and “B” shares is different due to their Netherlands- and Britain-based listings. Therefore, Brits tend to buy the B shares whereas Dutch investors favour the A shares.

-

This goes back all the way to 1907 when a Dutch company and a UK company merged but kept their separate legal existences. Now that the two companies are properly combined, you can still buy “A” and “B” shares that are aimed at Netherlands and British investors respectively.

How did the shares react to the Q3 2021 energy crisis?

The RDS share prices both shot up when an international energy crisis appeared to be unfolding in September 2021.

-

However good you think a company’s prospects are, you should never invest all your money in a single stock that will render your entire portfolio worthless if the company goes bust. Diversification is the name of the game, which means spreading your money across several stocks and other assets such as gold.

-

If your stock position has moved into profit (e.g., by 20%) you can apply a “stop order” to sell your stake automatically if the price falls back by a certain amount (e.g., 10%) to protect at least some of your accrued profit. A trailing stop order will automatically ratchet upwards, protecting more of your money as your stock position moved further into profit.

-

No. In fact, stop orders are often called “stop-loss orders” because their main purpose is to automatically sell your shares from a small loss before it becomes a big loss when the share price plummets.