How to buy Philips stocks in 2025

Koninklijke Philips N.V. (Royal Philips), often shortened to Philips, is a Netherlands-based multinational company that offers health technology solutions across Europe and the rest of the world. Formerly one of the largest electronics companies in the world, Philips now focuses more on the area of health technology.

Although founded in Eindhoven, its headquarters were moved to Amsterdam in 1997. The company is primarily listed on the Euronext Amsterdam stock exchange but is also traded on the New York Stock Exchange. Philips is a member of the Euro Stoxx 50 Index, an equity index of the largest 50 companies in Europe.

This guide tells you how you can buy Philips stock, and why you might want to, taking various fundamental factors into account.

How to Buy RYLPF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Best Reviewed Brokers to Buy Philips Stocks

1. eToro

eToro is one of the most prominent social investment networks, with a mission to improve investors' knowledge and activity regarding finance. Since its inception in 2007, eToro has become the premier investment platform for novice and experienced traders, with a user base of over 17 million. You can read our full eToro review here.

Security and Privacy

When choosing an investment platform, security is among the biggest factors to consider. Since eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), you can be assured that your funds and personal details are secure. Furthermore, eToro SSL encrypts all submissions to safeguard against hackers trying to intercept confidential information. Finally, the platform has two-factor authentication (2FA) to ensure the users’ accounts are safe.

Fees & Features

Both inexperienced and seasoned investors can take advantage of eToro's extensive library of cutting-edge trading methods. For instance, beginners in trading can take advantage of CopyTrading available on eToro as it allows them to mimic the actions of more experienced traders. Those with trading experience will be glad to find that eToro provides access to many markets, such as stocks, currencies, and cryptocurrency, all from one platform. Also, eToro is a commission-free service. However, the platform charges a monthly fee of £10 for inactivity to promote active trades on the platform.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

| Deposit Fee | £0 |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com, which originated in 2016, is an excellent multi-asset broker. With over 5 million users, it has established itself as a low-cost platform with low overnight fees, tight spreads, and 0% commission. You can read our full Capital.com review here.

Security and Privacy

Capital.com is an FCA, CySEC, ASIC, and NBRB-licensed corporation dedicated to providing the most effective trading experience in the world. It shows that users' data is secured and hidden on Capital.com, since the site follows stringent criteria to achieve this goal. Capital.com takes client data security seriously, and one way it does this is by complying with the PCI Data Security Standards.

Fees & Features

Capital.com offers a wide variety of no-cost brokerage services. Its financial policies are transparent. Any fees you incur will be made clear before you pay them. Capital.com's principal costs come from spread charges, which are often low compared to competitors. The broker's mobile trading app features an AI-powered tool that gives clients personalized trading information by employing a detection algorithm. In addition, Capital.com's multilingual customers can get in touch with a representative via email, phone, or live chat.

| Fee Type | Fee Amount |

| Deposit Fee | £0 |

| Commission Fee | 0% |

| Inactivity Fee | £0 |

| Withdrawal Fee | £0 |

Pros

- Efficient email and chat support

- MetaTrader integration

- Commission-free trading

Cons

- Majorly restricted to CFDs

3. Skilling

Skilling is a multi-asset broker with significant growth. The broker offers excellent trading conditions regarding platform features and products available to experienced traders. Skilling now provides Forex, CFD, Stock, and cryptocurrency trading six years after its inception to individual investors. You can read our full Skilling review here.

Security and Privacy

When looking for a broker like Skilling, it is essential to check the broker's regulatory standing. Skilling is administered by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). In addition, the money that traders deposit into their Skilling accounts is held in a completely independent financial institution. For maximum safety, Skilling only uses top-tier financial institutions for this purpose. Tier 1 capital is the industry benchmark for measuring a bank's soundness.

Fees & Features

Skilling does not charge commissions for trading equities, indices, or cryptocurrencies. The platform charges Spreads which vary based on the share, but are typically very reasonable. Skilling offers two distinct account options for FX and metals CFD trading. The Standard Skill account has significantly larger spreads but no commissions. The Premium account charges commissions on spot metal and FX CFD trades for decreased spreads. Additionally, Skilling provides a demo account, mobile applications, and a trade assistant.

| Fee Type | Fee Amount |

| Commission Fee | £0 |

| Withdrawal Fee | Varies |

| Inactivity Fee | £0 |

| Deposit Fee | £0 |

Pros

- Great platform choice

- Demo accounts

Cons

- High Spreads

- Service is unavailable in many countries, including the US and Canada.

Everything You Need To Know About Philips

At this point, let’s take a detailed look at Philips by exploring its history and business strategy, how it makes money, and how the stock has performed in recent years.

Philips History

The Royal Philips Company was founded in 1891 by Gerard Philips and his father, Frederik Philips, who was a banker then. The company started with the production of carbon-filament light bulbs and other electro-technical products in 1892 but later expanded into consumer electronics. It started manufacturing electronics in the early 20th century. Its first shortwave radio station, PCJJ (later PCJ), went on the air on 11 March 1927.

In 1939, the company started making electric shavers under the Philishave brand, and after WWII, it developed the Compact Cassette format and co-developed the Compact Disc format with Sony. It gained its royal honorary title in 1998. In 2013, the company started refocusing from consumer electronics to healthcare technology and dropped the "Electronics'' in its name — becoming Royal Philips N.V. Its lighting division spun off as a separate company, Signify N.V., in 2016.

Philips acquired Volcano Corporation in 2015 to strengthen its position in non-invasive surgery and imaging, and in 2017, it announced it would acquire Spectranetics Corp, a US-based manufacturer of devices for treating heart disease.

What Is Philips’s Strategy?

Philips started with making light bulbs and later diversified into consumer electronics. In recent years, it started focusing on health technology. It aims to improve health in all aspects, from prevention and healthy living to diagnosis and treatment, as well as home care. With over 110 production facilities spread across 100 countries and a strong R&D department, Philips leverages advanced technology with deep consumer insights to deliver solutions across home care and consumer health.

The company’s strategy is to lead with innovative solutions that combine systems, smart devices, informatics, and services while leveraging big data and retail trade partners to deliver the right products to a wide target market.

How Does Philips Make Money?

The company makes money from the sale of its products and services. Philips categorises its products into three segments: Diagnosis & Treatment, which was formerly known as Philips Medical Systems and focuses on diagnostic imaging and image-guided therapy; Connected Care, which focuses on patient monitoring systems sleep & respiratory care, and emergency care & resuscitation (ECR) solutions; and Personal Health (formerly Philips Consumer Electronics and Philips Domestic Appliances and Personal Care), which include oral healthcare products, mother & child care products, personal care products, and domestic appliances.

How Has Philips Performed in Recent Years?

Over the last two decades or more, the stock has had a mixed performance. It fell from its all-time high of €57.14 in September 2000 to below €15 in 2002. It gradually recovered in the following years, reaching as high as €32.61 in July 2007 before the great recession of 2008 drove it down to less than €12.

The stock swung up and down for some years before it started making a sustained upsurge from 2016 and got as high as €50.86 in April 2021. Since then, the stock has been in a deep pullback. As of October 7, 2021, the stock trades around €37.33, which is about 26.6% below the April 2021 high.

Source: Yahoo! Finance

Where Can You Buy Philips Stock?

Unlike trading the CFD or spread betting, which is all about speculating on the price movements of a stock, buying stock from a stockbroker gives you ownership of the company’s shares you buy. So, if you want to own shares, buy from a stockbroker rather than a CFD or spread betting platform although, some of them also allow you to buy real stocks.

Philips stock trades on the Euronext Amsterdam stock exchange and the New York Stock Exchange (NYSE), so you can buy it from any stockbroker with access to those stock exchanges. While most stockbrokers offer only standard share dealing accounts, UK-based ones may also offer shares ISA and SIPP accounts, which are tax-efficient. You can also buy Philips DR from any major commercial bank with a share dealing arm in your country of residence.

Philips Fundamental Analysis

Unlike in technical analysis where traders study the historical price action to find patterns that can predict future price movements, with fundamental analysis, the focus is on the company’s business and how it makes money. The idea is to know the intrinsic value of the stock.

In this guide, we will explain some of the factors to consider when performing fundamental analysis of a stock, and they include the P/E ratio, revenue, earnings-per-share, dividend yield, and cash flow.

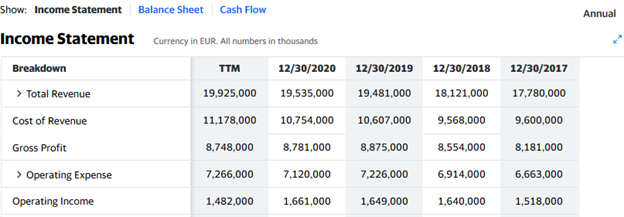

Philips’s Revenue

A company’s revenue is the amount of money it generates from the sales of its products or services. It is the first item recorded in the income, which is why it is also referred to as the top line. A higher revenue compared to the preceding quarter or a similar period in the preceding year appeals to investors and can make the stock perform better.

Philips’ revenue for the 2020 fiscal year, which ended December 30, 2020, was 19.54 billion EUR — a growth of about 0.3% over the 2019 figure (19.48 billion EUR).

Source: Yahoo! Finance

Philips’s Earnings-per-Share

A company’s earnings refer to the profits it makes in an accounting period after all costs of doing business have been deducted from its revenues. It is placed at the bottom of the income statement, which is why it is usually referred to as the “company’s bottom line”.

What concerns you more as an investor who doesn’t own the entire company is the earnings per share (EPS), which refers to the amount the company earned for each outstanding share of its common stock. You can calculate Philips’ EPS by dividing its net earnings (minus dividends paid to preferred stockholders) by the number of common shares outstanding. However, you can get the metric from your stockbroker’s websites or any major financial website. Philips’ EPS for the 2020 fiscal year was €1.31.

Philips’s P/E Ratio

The price-earnings (P/E) ratio compares a company’s share price to its earnings-per-share. While you can calculate it by dividing the current share price by the EPS, you can easily see it on your broker’s website or a financial website.

Given Philips’ share price of €37.33 and EPS of €1.31, its P/E ratio would be about 28.50. What this implies is that as of October 7, 2021, investors are willing to pay €28.50 for every euro the company earns in profits per annum.

A stock with a very high P/E ratio is usually considered overvalued, but there is no cutoff level for the P/E ratio to know which is high or low. Investors often compare with those of similar stocks to have an idea. They can even continue buying a stock with a high P/E ratio if they anticipate higher earnings in the future. This is why the PEG ratio, which factors in earnings growth, might be a better metric.

Philips’s Dividend Yield

Dividends are cash payments a company offers to its shareholders for investing in the company. They are usually paid quarterly, semi-annually, or annually. Not all companies pay dividends; some retain their earnings. Philips pays annual dividends; it paid a dividend of €0.85 per share for the 2020 fiscal year. When a dividend is declared, the company’s share price rises until after the ex-dividend date and then declines.

The dividend yield compares a company’s total annual dividends to its share price. For example, a company that pays an annual dividend of €0.85 per share when its share price is €37.33 would have a dividend yield of 2.28%. You can easily see this metric alongside other financial ratios on your stockbroker’s website or any of the major financial websites.

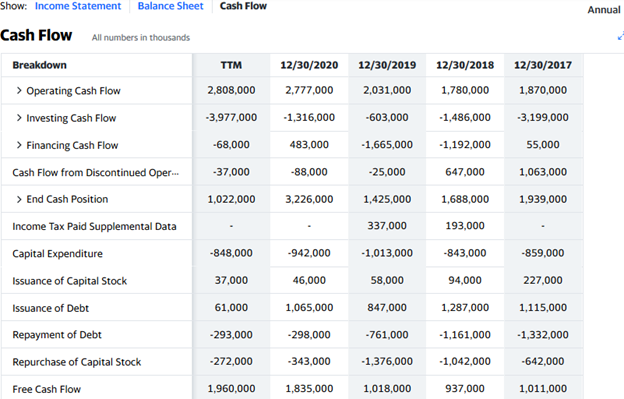

Philips’s Cash Flow

A company’s cash flow record is seen in the cash flow statement, which is one of the three financial statements you will see in the financial section of the company’s information on a broker’s website or any of the major financial websites. It is a record of how the company generates and spends cash.

When studying the cash flow statement, focus on the free cash flow, which represents the amount of cash or cash equivalents the company has left after paying for major expenses necessary for running the business, such as building, equipment, and other bills. It is the free cash the company has to pay dividends, fund its expansion, or pay down debts.

In Philips’ cash flow statement below, you can see that the company had over €1.8 billion in free cash as of the end of 2020.

Source: Yahoo! Finance

Why Buy Philips Stocks?

Philips is in good financial health, as its fundamentals are solid with significant growth prospects. As you may already know, cash is the lifeblood of any business, and Philips’ cash flow statement shows that they have enough of it. With that cash, the company can pursue its new projects and growth plans, and it has proven over the years that it can easily adapt its business to suit consumers’ changing demands.

Here are three reasons you might want to buy Philips stocks:

The company is well managed, as evidenced by its solid fundamentals.

It has plenty of free cash to pursue.

It pays regular dividends.

Expert Tip on Buying Philips Stock

“ Philips is a growth stock with huge prospects, but as of October 7, 2021, the stock is in a deep pullback (over 26% below its most recent high). So, the stock would attract both growth and value investors and can reverse at any time. Using a limit order might not be the best idea as the trade may not be triggered. You might want to wait and enter with a market order after the stock has reversed. ”

5 Things to Consider Before You Buy Philips Stock

You must consider these five things before investing in any stock.

1. Understand the Company

Of course, it makes sense to invest in a company you know; Peter Lynch and Warren Buffett even suggest that you invest in companies you use their products. However, you should go beyond that and study the company’s fundamentals to be sure that it is in a good financial state. That you use Philips electronics doesn’t mean that the company’s business model is profitable. So, you must study the company to find out how it makes money, whether it is actually making a profit, and how it spends the money.

2. Understand the Basics of Investing

It’s important to learn the basics of investing first before putting your money in the market. It makes it easy to flow with the broker and financial analysts and also reduces your chances of making a mistake and losing your money. Endeavour to learn about risk management, money management, and diversification, as well as how to analyse the market and execute orders.

3. Carefully Choose Your Broker

While it is very vital to choose a broker that charges low commission fees, offers intuitive trading platforms and apps, provides useful trading tools, supports various order types, allows multiple payment methods, and offers quick customer support, ensure your broker is licensed by the financial services regulator in your country of residence. This ensures the safety of your funds, as you would qualify for any financial compensation scheme in your country if the broker becomes insolvent.

4. Decide How Much You Want to Invest

Be sure not to invest more than you can afford to lose. As a beginner, don’t ever invest with borrowed money no matter how well you think a stock will perform — leverage is a double-edged sword; you can lose your shirt.

You should know the amount you want to invest and the percentage of your capital to allocate to one stock. Also, determine how you want to invest the money — buy all at once or scale in at intervals. While you can invest a lump-sum at once, it may be preferable to practice dollar-cost-averaging and scale in gradually so as to use market volatility to your advantage.

5. Decide on a Goal for Your Investment

Do you know your investment goal? Knowing why you are investing can help you ascertain how long to hold your investment. Your investment goal could be to build your pension fund for retirement or raise money for your kids’ college. Whatever your reason, just make sure you know when to sell. You can sell at a specific time in the future, when the price gets to a particular level, or when the company’s fundamentals no longer look good. You may even decide to hold the stock indefinitely and sell when you need money.

The Bottom Line on Buying Philips Stocks

Philips is a Netherlands-based multinational conglomerate that offers health technology solutions and consumer electronics across Europe and the rest of the world. You might want to invest in this well-managed company to benefit from its growth prospects, and you can do that through a stockbroker with access to Euronext Amsterdam or the NYSE.

If you want to invest in Philips stock right now, just sign up for a stockbroker’s stock trading account and fund it. Then, select Philips from the list of stocks on the broker’s platform and place an order to buy the stock.

Not ready to invest right now? No problem, continue to educate yourself by reading many other guides on our website until you are ready to invest. You may also “paper trade” using your stockbroker’s demo account to learn how the market works.

Frequently Asked Questions

-

A well-managed company is one whose management team is focused on creating more value for shareholders. The goal of any management is to maximise shareholders' wealth, and they achieve this by growing the company’s earnings, paying dividends, and using retained earnings for productive ventures (not squandering the money on corporate jets and too many executive bonuses).

-

Retained earnings are the portion of a company’s earnings that were not paid out to shareholders as dividends but were instead retained by the company. Companies use their retained earnings to finance projects that can drive growth and improve their income.

-

Paper trading helps you to familiarise yourself with your broker’s trading platform. You learn how to place orders and set your risk management parameters. It also affords you the opportunity to see how your analysis plays out in the market; so you can confirm your strategy or know whether to tweak it a little. However, it does not allow you to develop your trading psychology.

-

When you are paper trading, you are trading with virtual money. Your money is not at risk, so your trading emotions are not triggered. Without feeling those emotions, you can’t learn how to manage them. To develop your trading psychology, you have to trade with real money. But it’s better to start with a small amount and gradually increase your stake size.

-

Money management is a technique you use to control how much you stake in each trade so that you don’t lose most of your trading capital in one trade. The idea is that you risk only a small portion (say 2%) of your trading capital in each trade so that if you lose it, you still have enough money to trade with.

-

As a common shareholder in a company, you have some rights. You have the right to transfer ownership by trading the stock on the exchange, and you are also entitled to dividends. For most stocks, you also have voting rights, but some companies like Berkshire Hathaway have different classes of shares, with Class B shares having much lower voting rights.